Reading Speculators’and Hedgers’ Positions in Gold

Large speculators and traders continued to reduce their bullish net positions in gold futures markets last week for the eighth consecutive week.

By Meera Shawn

Jan. 10 2017, Updated 5:35 p.m. ET

COT data

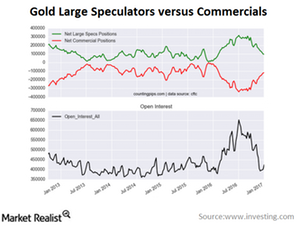

According to COT (Commitment of Traders) data released by the CFTC (U.S. Commodity Futures Trading Commission), large speculators and traders continued to reduce their bullish net positions in gold futures markets last week, for the eighth consecutive week. According to weekly data reported on January 3, 2017, hedge funds and speculators totaled a net position of 96,550 contracts. That compares to the previous week’s 98,343 net contracts. That was a weekly change of -1,793 contracts.

Gold miners and funds

On the other hand, commercial traders and hedgers totaled a net position of -117,612 contracts last week. It was a weekly change of 3,355 contracts from the total net of -120,967 contracts reported in the previous week.

As you can see in the above graph, open interest in gold has deteriorated since the last quarter of 2016.

The Fed’s interest rate hike in December 2016 was one of the primary reasons for the open interest as well as the fall in prices. Mining companies that have rebounded in January 2017 due to the rise in prices include Sibanye Gold (SBGL), Gold Fields (GFI), Randgold Resources (GOLD), and Coeur Mining (CDE).

Article continues below advertisement