Why Monsanto’s Operating Margins Improved in 1Q17

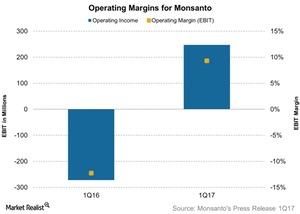

Monsanto reported operating income or EBIT of $247 million, which rose from -$272 million in fiscal 1Q16.

Jan. 9 2017, Updated 7:36 a.m. ET

Operating margins

During fiscal 1Q17, Monsanto (MON) experienced an expansion in its operating margins as compared to fiscal 1Q16. The company reported operating income or EBIT (earnings before interest and tax, calculated by using gross income minus operating expenses) of $247 million, which rose from -$272 million in fiscal 1Q16.

The company’s 9% EBIT margin in fiscal 1Q17 was better than its -12% one year previously.

Why EBIT margins improved?

The improvement in YoY (year-over-year) sales certainly trickled down to the operating income, but the company was also able to improve its cost metrics. SG&A (selling, general, and administrative) costs as a percentage of sales contracted from 24% in 1Q16 to 22% or $585 million in 1Q17. R&D (research and development) expenses fell from 16% in 1Q16 to 14%, or $370 million, in 1Q17 as a percentage of sales.

The company noted that reduced restructuring expenses offset expenses related to the transaction costs with Bayer, giving a lift to operating margins during the quarter.

The company also stated that fluctuation in exchange rates in relation to business in South America impacted the company’s margins negatively. We should note that currency fluctuations are not limited to Monsanto but also affect companies (NANR) like Syngenta (SYT), FMC Corporation (FMC), and PotashCorp (POT).