Deutsche Bank: Analyzing Its Capital Levels

Deutsche Bank is proving to be the most dangerous bank to the global economy. It failed the Fed’s 2016 stress tests in June 2016.

Jan. 25 2017, Published 9:13 a.m. ET

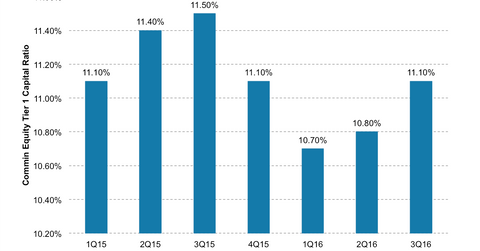

Deutsche Bank’s capital levels

Deutsche Bank (DB) is proving to be the most dangerous bank for the global economy. It failed the Fed’s 2016 stress tests in June 2016. The bank’s stock fell nearly 25% in 2016. Capital reserves are important because they help restore regulators and investors’ confidence. IMF labeled it as the “riskiest bank” to the global economy after it failed to meet 2016 capital requirements.

A closely tracked measure of financial strength, the Common Equity Tier 1 Capital Ratio rose to 11.1% in September from 10.8% in the previous quarter. Deutsche Bank set a target of 12.5% for the Common Equity Tier 1 Capital Ratio by the end of 2018. While Tier 1 capital is still within the current regulatory minimum, it’s below the ratio required by 2019. European counterparts (EUFN) such as Credit Suisse (CS), UBS, and Royal Bank of Scotland (RBS) have been struggling to build capital reserves to meet regulatory requirements.