China Imported Record Iron Ore in 2016: How’s the 2017 Outlook?

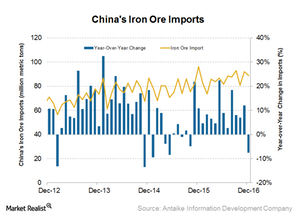

China’s iron ore imports were robust in 2016. While the country’s imports fell 7.6% year-over-year (or YoY) in December 2016, they hit a yearly record in 2016.

Jan. 30 2017, Updated 10:35 a.m. ET

Record iron ore imports

Contrary to what was expected by many market participants, China’s iron ore imports were robust in 2016. While the country’s imports fell 7.6% year-over-year (or YoY) in December 2016, they hit a yearly record in 2016. China’s 2016 iron ore imports came in at 1.0 billion tons, an annual rise of 7.5%.

This rise was the result of two factors: resilient steel demand in China, partly driven by government stimulus measures, and the replacement of Chinese domestic iron ore production by the import of cheaper high-grade ore imports, mainly from Australia and Brazil.

Customs data and China’s iron ore imports

China tracks its iron ore imports through customs data. This information is important for investors because it provides a good idea of the appetite for imported iron ore among Chinese mills and traders. China consumes more than two-thirds of all seaborne iron ore, so its import appetite affects iron ore players involved in seaborne iron ore trade. These companies include Cliffs Natural Resources (CLF), Vale (VALE), and Rio Tinto (RIO).

The iShares MSCI Global Metals & Mining Producers ETF (PICK) invests in iron ore, so this information affects it as well. BHP Billiton (BHP) is PICK’s top holding, making up 16.7% of the fund. The SPDR S&P Metals & Mining ETF (XME) also invests in some of the above-mentioned stocks.

Factors impacting imports

Higher prices and the usual slowdown leading into the winter months could lead to softer demand for iron ore. Less demand will be negative for iron ore prices. However, in the long term, as China shuts down its steel capacity, which mostly uses scrap metal, iron ore imports could see an upside.

In the next part of this series, we’ll see what’s supporting the current trend in steel production in China.