How Did Danaher’s Operating Segments Fare in 4Q16?

Currently, Danaher (DHR) reports its revenue under four operating segments: Life Sciences, Diagnostics, Dental, and Environmental & Applied Solutions.

Feb. 2 2017, Updated 1:05 p.m. ET

Danaher’s operating segments

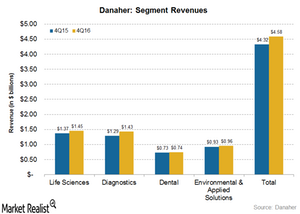

Currently, Danaher (DHR) reports its revenue under four operating segments: Life Sciences, Diagnostics, Dental, and Environmental & Applied Solutions. These segments represented ~31.8%, 29.8%, 16.5%, and 21.9% of the company’s total revenue, respectively, in 2016.

Life Sciences and Diagnostics segments

Danaher continues to derive a major portion of its total revenue from its Life Sciences segment. In 4Q16, the company reported revenue of $1.5 billion in its Life Sciences segment, compared to $1.4 billion in 4Q15. This was a ~6% rise on a YoY (year-over-year) basis. The segment’s core revenue rose 4% YoY.

Apart from established healthcare (IHF) players such as Roche Holding (RHHBY) and Varian Medical Systems (VAR), DHR faces competition in this segment from industrial (XLI) companies such as General Electric (GE).

The Diagnostics segment witnessed an ~11% rise in revenue from $1.3 billion in 4Q15 to $1.4 billion in 4Q16. The segment’s core revenue rose ~3% YoY.

Dental and Environmental & Applied Solutions segments

In 4Q16, DHR’s Dental segment’s revenue rose marginally to $0.74 billion, compared to $0.73 billion in 4Q15. Danaher treats its dental platform as a new acquisition. The segment’s reported and core revenue rose ~0.5% YoY.

According to DHR’s earnings call, the Dental segment witnessed solid growth in its specialty a product lines business, which was mostly offset by continued weakness in its traditional consumables and equipment business. Moreover, the company expects challenging conditions to persist for its Dental segment’s business in early 2017.

DHR’s Environmental & Applied Solutions segment witnessed a ~3.5% rise in its YoY revenue to $0.96 billion in 4Q16, compared to $0.93 billion in 4Q15. The segment’s core revenue rose 4% YoY in 4Q16.

In 4Q16, DHR’s consolidated revenue came in at $4.6 billion, compared to analysts’ revenue estimate of $4.5 billion. The deviation from analysts’ expectations was primarily due to higher revenues from the company’s Life Sciences and Diagnostics segments. Also, the company’s core revenue rose 3.5% in 4Q16, compared to an anticipated core revenue rise of 3.0%.

Next, we’ll look into DHR’s 4Q16 operational performance.