Snyder’s-Lance Plans to Sell Diamond of California

Snyder’s-Lance (LNCE) fell 4.4% to close at $36.22 per share during the fifth week of November 2016.

Dec. 6 2016, Updated 8:06 a.m. ET

Price movement

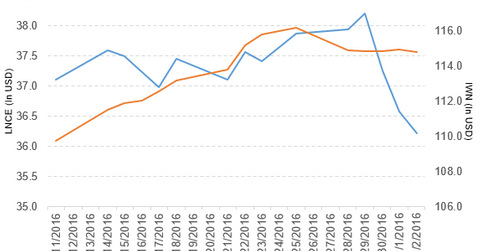

Snyder’s-Lance (LNCE) fell 4.4% to close at $36.22 per share during the fifth week of November 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -4.4%, 4.1%, and 7.7%, respectively, as of December 2, 2016.

LNCE is trading 1.8% below its 20-day moving average, 2.0% above its 50-day moving average, and 9.1% above its 200-day moving average.

Related ETF and peers

The iShares Russell 2000 Value (IWN) invests 0.34% of its holdings in LNCE. The YTD price movement of IWN was 26.6% on December 2.

The market caps of Snyder’s-Lance’s competitors are as follows:

Latest news on LNCE

In a press release on November 28, 2016, Snyder’s-Lance reported that it has “signed a definitive agreement to sell its Diamond of California culinary nut business to Blue Road Capital. The sale of Diamond of California aligns with the Company’s strategy to focus more resources on the growth opportunities for its core brands. The transaction reflects the Company’s commitment to improving capital efficiency and is anticipated to be accretive to both returns on invested capital and operating margins.”

Snyder’s-Lance expects the deal to close at the end of 2016.

Performance of Snyder’s-Lance in fiscal 2Q16

Snyder’s-Lance (LNCE) reported fiscal 2Q16 net revenue of $609.5 million, a rise of 41.3% compared to $431.4 million in fiscal 2Q15. Its net income rose to $19.7 million, and its EPS (earnings per share) fell to $0.20 in fiscal 2Q16. That compares to net income and EPS of $17.3 million and $0.24, respectively, in fiscal 2Q15.

Snyder’s-Lance reported adjusted EBITDA[1. earnings before interest, tax, depreciation, and amortization] and adjusted EPS of $78.6 million and $0.28, respectively, in fiscal 2Q16. Those figures represent rises of 56.6% and 3.7%, respectively, compared to fiscal 2Q15.

LNCE’s cash and cash equivalents fell 3.6%, and its inventories rose 106.0% in fiscal 2Q16 compared to fiscal 4Q15.

Projections

Snyder’s-Lance (LNCE) has made the following projections for fiscal 2016:

- net revenue of $2.29 billion–$2.33 billion, which excludes the contribution from Diamond Foods’ net revenue growth of flat to 2.0%

- adjusted EBITDA of $313.0 million–$325.0 million

- capital expenditure of $80.0 million–$85.0 million

- EPS of $1.22–$1.30, which excludes special items and charges for the acquisition of Diamond Foods

- effective tax rate of 34.0%–35.0%

It expects EPS of $0.28–$0.31 for fiscal 3Q16.

In the next part, we’ll look at Under Armour (UA).