What’s the Outlook for Chinese Iron Ore Imports?

Contrary to what’s been suggested by many market participants, China’s iron ore imports have been robust in 2016. In November, imports were 92.0 million tons.

Dec. 28 2016, Updated 9:05 a.m. ET

China’s robust iron ore imports

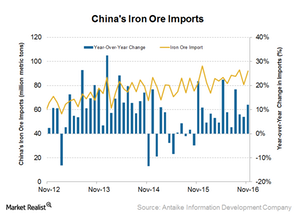

Contrary to what’s been suggested by many market participants, China’s iron ore imports have been robust in 2016. In November, imports were 92.0 million tons, a rise of 13.8% month-over-month. On a year-over-year basis, imports rose 7.0%.

In the first ten months of 2016, iron ore imports reached 844.0 million tons, which was 12.0% higher than the same period in 2015. There was no apparent reason for the spike in iron ore imports. Some market participants suggested that it reflects adjustments after the holiday period.

For the first 11 months of the year, imports have reached 935.0 million tons. They’re set to beat the all-time high of 953.0 million tons of import volumes for 2015.

Customs data and China’s iron ore imports

China tracks its iron ore imports through customs data. This information is important for investors because it provides a good sense of the appetite for imported iron ore among Chinese mills and traders. China consumes about two-thirds of all seaborne iron ore, so its import appetite impacts iron ore players involved in seaborne iron ore trade. These companies include Cliffs Natural Resources (CLF), Vale SA (VALE), and Rio Tinto (RIO).

The iShares MSCI Global Metals & Mining Producers (PICK) invests in iron ore, so this information affects it as well. BHP Billiton (BHP) is PICK’s top holding, making up 16.7% of the fund. The SPDR S&P Metals & Mining ETF (XME) also invests in some of these stocks.

Pullback in demand

The supply of coking coal, another ingredient used in making steel, remains constrained, which could lead to higher steel prices. Higher coking coal and iron ore prices have started eroding steelmakers’ profits, resulting in a slowdown in production. Higher prices along with the usual slowdown leading into the winter months could lead to softer demand. Less demand will be negative for iron ore prices.

In the next part of this series, we’ll see what’s supporting the current trend in steel production in China.