AstraZeneca’s Lynparza Is Still a Leading PARP Inhibitor in 2016

On October 26, 2016, AstraZeneca (AZN) announced that Lynparza managed to demonstrate a superior clinical profile in the Phase 3 SOLO-2 trial.

Jan. 2 2017, Updated 9:06 a.m. ET

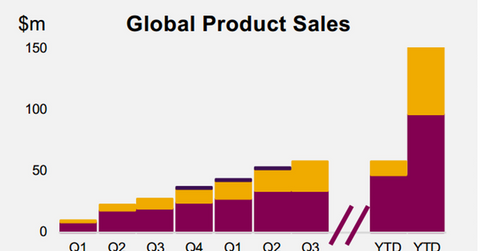

Lynparza’s growth trends

On October 26, 2016, AstraZeneca (AZN) announced that Lynparza managed to demonstrate a superior clinical profile in the Phase 3 SOLO-2 trial as a maintenance therapy for patients suffering with platinum-sensitive and BRCA-gene (breast cancer–gene) ovarian cancer. The trial established the efficacy of the drug based on superior progression-free survival rates.

Currently, Lynparza is a leading poly ADP-ribose polymerase (or PARP) inhibitor and has been used by approximately 5,000 patients in 30 countries. If the drug manages to secure regulatory approval for additional indications in the ovarian cancer space, it may boost AstraZeneca’s (AZN) share prices as well as those of the First Trust Value Line Dividend ETF (FVD). AstraZeneca makes up about 0.52% of FVD’s total portfolio holdings.

Revenue trends

Lynparza has earned revenues of $156.0 million in 2016 on a year-to-date (or YTD) basis. The drug is also being reviewed by regulatory agencies in seven other countries. Lynparza has also strengthened its position in the Japanese market.

BRCA testing has currently penetrated about 70.0% of the eligible population in the United States and Europe. As BRCA testing rates continue to increase, sales of Lynparza may rise. Improving BRCA testing is also expected to prove beneficial for other investigational PARP inhibitors such as AbbVie’s (ABBV) veliparib and Pfizer’s (PFE) talazoparib.

Lynparza is also expected to benefit from a better safety profile and higher tolerability. There have been limited instances of dose reductions due to thrombocytopenia in patients. That could help strengthen the drug’s position as a potent oncology drug. Lynparza could thus enable AstraZeneca to pose strong competition to other ovarian cancer therapy players such as Roche Holdings (RHHBY) and Eli Lily.

In the next part of this series, we’ll look at the growth prospects for oncology drug Faslodex.