LKQ’s New Plans and Moody’s Comments

LKQ (LKQ) fell 4.6% to close at $30.93 per share during the third week of December 2016.

Nov. 20 2020, Updated 2:04 p.m. ET

Price movement

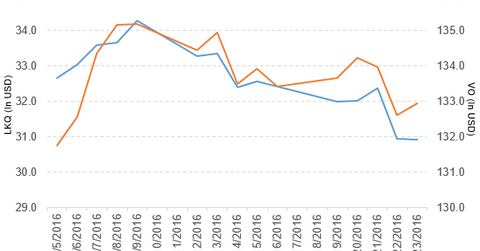

LKQ (LKQ) fell 4.6% to close at $30.93 per share during the third week of December 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -4.6%, -7.1%, and 4.4%, respectively, as of December 23.

LKQ is trading 5.7% below its 20-day moving average, 5.2% below its 50-day moving average, and 6.7% below its 200-day moving average.

Related ETF and peers

The Vanguard Mid-Cap ETF (VO) invests 0.28% of its holdings in LKQ. The YTD price movement of VO was 12.4% on December 23.

The market caps of LKQ’s competitors are as follows:

Latest news on LKQ

In a press release on December 19, 2016, LKQ “announced that it has entered into a definitive agreement to sell the OEM [original equipment manufacturer] glass manufacturing business of its Pittsburgh Glass Works subsidiary ([or ‘PGW’) to a subsidiary of Vitro S.A.B. de C.V. (BMV:VITROA), a leading glass manufacturer based in Mexico. The sale price is $310 million, subject to potential post-closing purchase price adjustments.”

It also noted, “As part of the transaction, LKQ and Vitro entered into a multi-year supply agreement pursuant to which LKQ’s ongoing aftermarket glass distribution business will purchase a specified amount of its automotive glass from Vitro at specified prices.”

The company added, “The transaction is expected to be completed in the first quarter of 2017 and is subject to customary closing conditions and necessary regulatory approvals.”

Moody’s comments

Moody’s Investors Service said the selling of the OEM glass manufacturing business to Vitro S.A.B. de C.V. from LKQ is a credit positive event. Moody’s also left the company’s Corporate Family Rating of Ba1 and negative ratings outlook unchanged.

Performance of LKQ in 3Q16

LKQ reported 3Q16 revenue of $2.4 billion, a rise of 30.3% compared to revenue of $1.8 billion in 3Q15. The company’s gross profit margin and operating margin narrowed 190 basis points and 60 basis points, respectively, in 3Q16 compared to the prior year’s period.

Its net income and EPS (earnings per share) rose to $122.7 million and $0.40, respectively, in 3Q16 compared to $101.3 million and $0.33, respectively, in 3Q15. It reported adjusted EPS of $0.45 in 3Q16, a rise of 25.0% compared to 3Q15.

Projections

LKQ has made the following projections for fiscal 2016:

- organic revenue growth for parts and service of 4.5%–5.0%

- adjusted net income of $551.0 million–$569.0 million

- adjusted EPS of $1.78–$1.84

- cash flow operations of $575.0 million–$600.0 million

- capital expenditures of $200.0 million–$225.0 million

In the next and final part of this series, we’ll take a look at Autoliv (ALV).