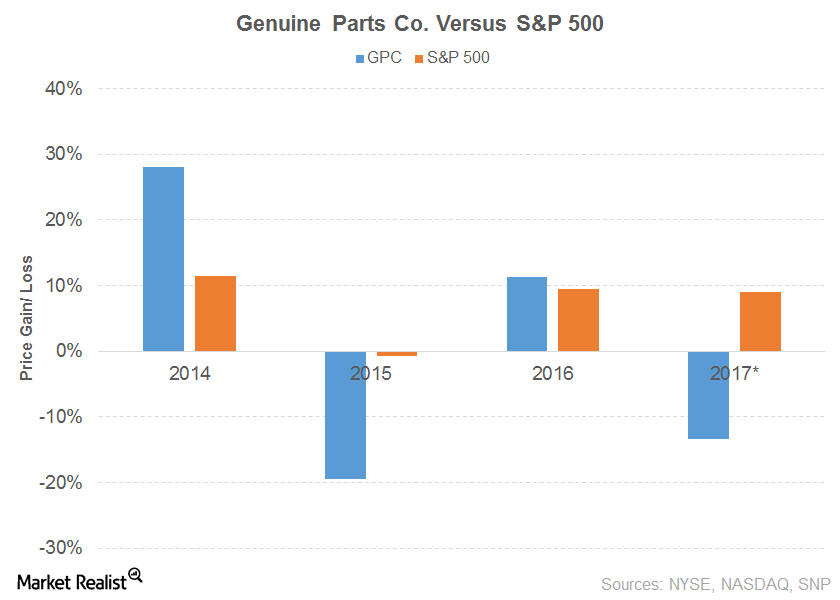

Genuine Parts Co

Latest Genuine Parts Co News and Updates

LKQ’s New Plans and Moody’s Comments

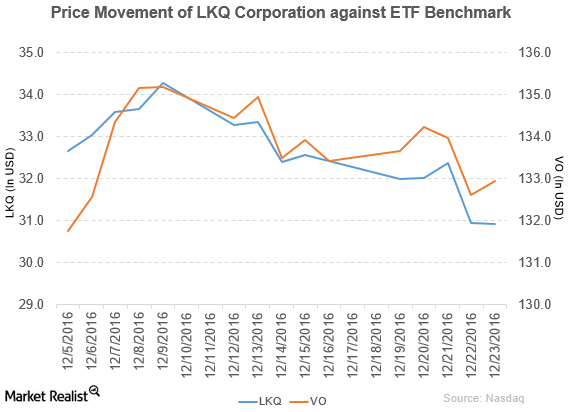

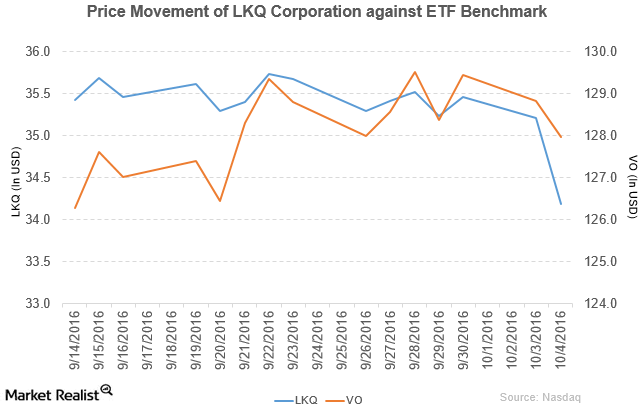

LKQ (LKQ) fell 4.6% to close at $30.93 per share during the third week of December 2016.

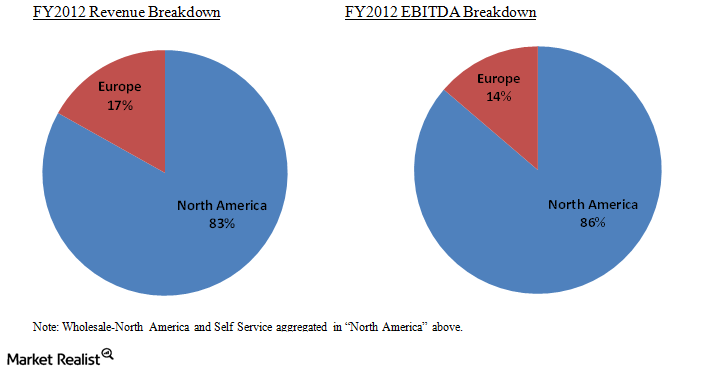

An investor’s must-know guide to LKQ’s 3 operating segments

LKQ is the nation’s largest provider of alternative vehicle collision replacement products and a leading provider of alternative vehicle mechanical replacement products.

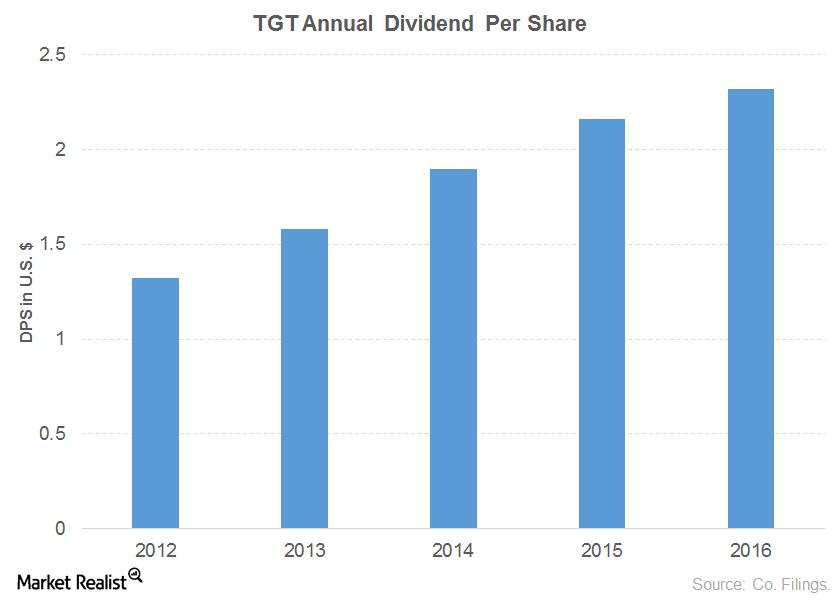

Will Genuine Parts Sustain Its Dividend Yield?

Genuine Parts (GPC) recorded a marginal growth in its 2016 net sales, driven by its Automotive and Office Products segments.

Consumer Discretionary: Which Are the Top Dividend Growers?

Consumer Discretionary Select Index sales, earnings, and dividends have grown at a CAGR (compound annual growth rate) of 6%, 7.2%, and 10.7%, respectively between 2012 and 2017.

LKQ Announced New Acquisition to Expand Its Presence in the UK

LKQ Corporation (LKQ) reported 2Q16 revenue of $2.5 billion, a rise of 38.9% compared to revenue of $1.8 billion in 2Q15.