LKQ Corp

Latest LKQ Corp News and Updates

LKQ’s New Plans and Moody’s Comments

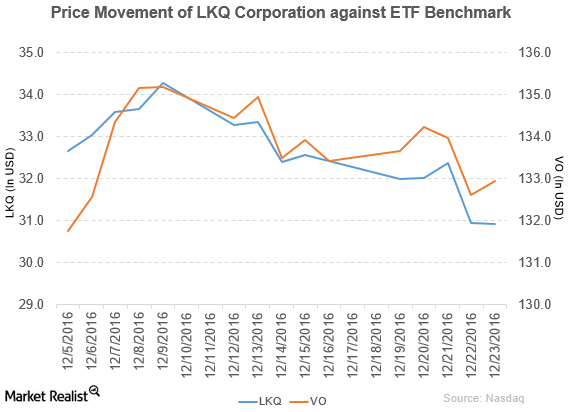

LKQ (LKQ) fell 4.6% to close at $30.93 per share during the third week of December 2016.

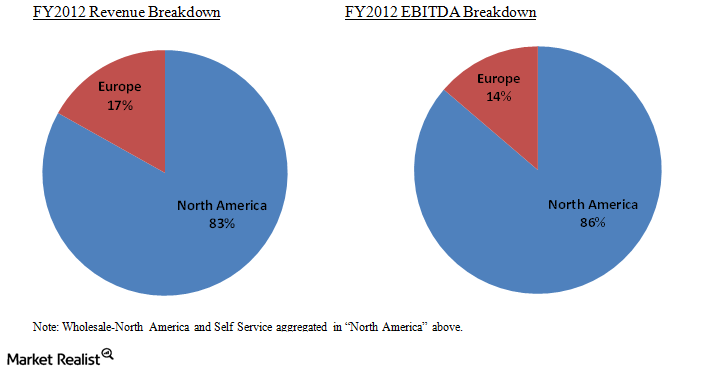

An investor’s must-know guide to LKQ’s 3 operating segments

LKQ is the nation’s largest provider of alternative vehicle collision replacement products and a leading provider of alternative vehicle mechanical replacement products.

LKQ Announced New Acquisition to Expand Its Presence in the UK

LKQ Corporation (LKQ) reported 2Q16 revenue of $2.5 billion, a rise of 38.9% compared to revenue of $1.8 billion in 2Q15.