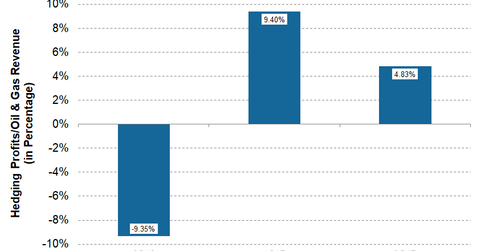

Chart in Focus: Marathon Oil’s Hedging Effectiveness

According to Marathon Oil’s (MRO) financials, MRO reported total (non-cash and cash) gains of ~$43.0 million on its 2Q17 crude oil and natural gas derivatives.

Oct. 3 2017, Updated 7:38 a.m. ET

Marathon Oil’s hedging effectiveness

According to Marathon Oil’s (MRO) financials, MRO reported total (non-cash and cash) gains of ~$43.0 million on its 2Q17 crude oil and natural gas derivatives. When divided by Marathon Oil’s oil and gas revenues of ~$891.0 million, that results in a positive hedging effectiveness of ~5.0%.

In other words, in 2Q17, profits on hedging instruments caused Marathon Oil’s oil and gas revenue to increase by ~5.0%. That’s much better than 2Q16 when it reported negative hedging effectiveness of ~9.0%.

Did Marathon Oil make a profit on settled derivatives in 2Q17?

For 2Q17, crude oil (OIL) (SCO) hedging activities increased Marathon Oil’s North America E&P (exploration and production) average realized crude oil price by $1.07 per barrel. As we saw in Part 7 of this series, excluding hedges, MRO’s North America E&P crude oil realized price was $45.81 per barrel in 2Q17. That means that commodity hedging activities increased MRO’s North American E&P average realized crude oil price by ~2.0%.

Other oil and gas producers

Almost all producers are involved in hedging, but their hedging effectiveness varies due to hedge types, hedge prices, and derivative coverage. MRO’s peer Southwestern Energy (SWN) has derivative coverage of ~60.0% of its forecast 2017 production. Another peer, ConocoPhillips (COP), made a profit of $2.99 per boe (barrel of oil equivalent) on its hedges in 2Q17.