Can Cliffs Natural Resources Scale Greater Heights in 2017?

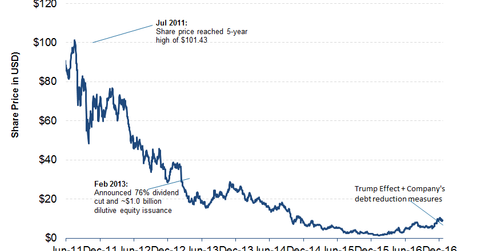

Cliffs Natural Resources (CLF) was trading at $8.85 on December 23, 2016, which represents a 46% rise since Donald Trump’s win in the US presidential election. That brings the year-to-date rise to a whopping 430.0%.

Dec. 28 2016, Published 12:35 p.m. ET

Cliffs Natural Resources: Higher highs

Cliffs Natural Resources (CLF) was trading at $8.85 on December 23, 2016, which represents a 46% rise since Donald Trump’s win in the US presidential election. That brings the YTD (year-to-date) rise to a whopping 430.0%.

In contrast, Cliffs Natural Resources stock lost 78% in 2015. Even in the beginning of 2016, CLF was on the verge of being reduced to a penny stock when it traded at ~$1.26 per share.

Among the other steelmakers (SLX), U.S. Steel (X), Nucor (NUE), ArcelorMittal (MT), and AK Steel (AKS) are also enjoying higher stock prices since Trump’s win on the prospects of higher demand.

Trump effect

Steel was mentioned in several of Trump’s speeches prior to the 2016 presidential election. Trump’s stance on protecting US steelmakers from the onslaught of foreign-made steel has caused several analysts to upgrade steel stocks after his election.

In this series

In this series, we’ll analyze how the US (SPY) steel sector could play out under Trump’s presidency. We’ll look at the view held by Cliffs Natural Resources’s CEO regarding the Trump factor for the company. We’ll also look at other fundamental factors that could impact Cliffs Natural Resources. We’ll see how CLF stock has performed to date and how it could perform going forward.

Let’s start by looking at the buying activity in Cliffs Natural Resources stock by institutional investors and funds for 3Q16.