Will Gold Keep a Close Watch on Inflation Numbers?

Donald Trump’s recent victory is shining a light on the possibility of a rise in inflation and how such a rise could work for gold.

Nov. 17 2016, Updated 5:04 p.m. ET

Gold versus other assets

When goods are expensive and above reasonable prices, it can be the result of inflation. Equity and debt investments aren’t ideal during these times, as fear tends to settle in among investors. They’re afraid of buying an asset at a higher price and having it underperform.

Historically, gold has performed well during periods of high inflation, and it has fallen during deflationary periods. Oil contributes a significant amount to inflation. As oil has rebounded, we could start to see inflation rise, which could make it wise for investors to fill up their portfolios with gold.

Donald Trump’s recent victory is shining a light on the possibility of a rise in inflation and how such a rise could work for gold. Rising inflation could mean that interest rates rise faster than expected. However, gold is much more dependent on the real interest rate than the nominal interest rate.

Inflation concerns

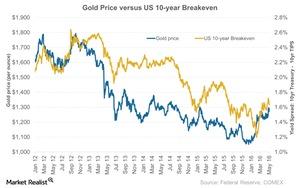

The large, deficit-funded fiscal stimulus is likely to push inflation well above the Federal Reserve’s 2% target, meaning that even if the Fed raises rates more aggressively, real interest rates should remain low. For analysis purposes, we’ll use the US 10-year breakeven inflation as a proxy for inflation. The US Treasury 10-year breakeven is the spread between the 10-Year Treasury yield and the TIPS (Treasury Inflation Protected Securities) yield.

The difference between yields on 10-Year US Treasury notes and similar-maturity TIPS, a gauge of price expectations, expanded to as much as 1.9% on November 14, 2016. This was the highest level of the index in the past year. The Federal Reserve targets 2% inflation, which doesn’t seem far off.

Funds and miners may follow

Mining stocks and funds could closely follow gold and other precious metals if they do indeed see a rise. Funds that closely associate with gold and silver include the PowerShares DB Gold ETF (DGL) and the VanEck Merk Gold Shares ETF (OUNZ). Mining companies that follow gold and silver include New Gold (NGD), Sibanye Gold (SBGL), Primero Mining (PPP), and Coeur Mining (CDE).