What Do Priceline’s Key Metrics Suggest?

From 2012 to 2014, Priceline Group’s (PCLN) gross bookings grew at an average of 30%. For 2015, accounting for the strong US dollar, growth was just 10%.

Nov. 3 2016, Updated 10:04 a.m. ET

Gross bookings grow

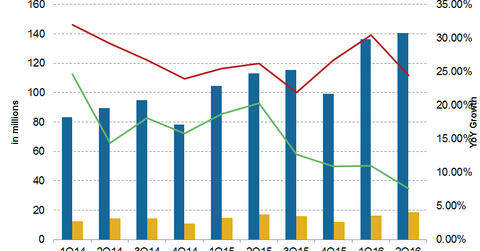

Gross booking is a metric used to measure the total value of all travel services purchased by customers. On a constant US dollar basis, gross bookings have shown strong growth, but the strong dollar has offset this growth. From 2012 to 2014, Priceline Group’s (PCLN) gross bookings grew at an average of 30%. For 2015, accounting for the strong US dollar, growth was just 10% (25% on a CC or constant currency basis).

Priceline’s growth momentum seems to have resumed in 2016. Gross bookings grew 21% YoY to $16.7 billion (26% on a CC basis) in 1Q16 and 19% YoY (year-over-year) to $17.2 billion (21% on CC basis) in 2Q16.

Accommodations: PCLN’s major contributor

A majority of this growth came from Priceline’s (PCLN) accommodations business. The company’s hotel room nights sold metric grew ~28% in 2014 and 25% in 2015. The metric continued a strong growth of 31% YoY in 1Q16 and 24.4% YoY in 2Q16. As more and more people shift to online booking, PCLN’s accommodation business is set to get stronger.

Rental car days

PCLN’s rental car business continues to grow too, albeit at a slower pace. For the first quarter of 2016, rental car days grew 11% YoY and at a slower 7.9% YoY rate in the second quarter. Rental car days accounted for ~12% of total bookings.

Air tickets

Meanwhile, the sale of online air tickets has been on a declining trend in the last few quarters, falling 6.6% YoY in 2Q16. However, this will not likely have an impact on PCLN’s business, as air ticket sales make up only 1% of PCLN’s total bookings.

Outlook

Priceline’s management expects 3Q16 gross bookings to grow 14%–19% YoY. Again, the majority of this is expected to come from its accommodations business, as room nights are expected to grow 18%–23%.

PCLN makes up ~2.6% of the total holdings of the iShares US Consumer Services ETF (IYC), which also has 0.55% in Expedia (EXPE) and 0.26% in TripAdvisor (TRIP). IYC does not invest in Ctrip.com International (CTRP).