Victoza Dominates Global GLP-1 Class

Novo’s (NVO) Victoza is a glucagon-like peptide-1 (or GLP-1) therapy for type 2 Diabetes patients.

Nov. 3 2016, Updated 8:04 a.m. ET

Victoza: Novo’s recent growth driver

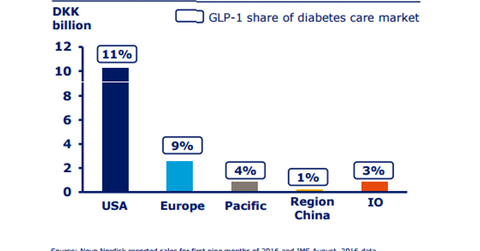

Novo’s (NVO) Victoza is a glucagon-like peptide-1 (or GLP-1) therapy for type 2 diabetes patients. During the first nine months of 2016, Victoza’s sales rose 13% in local currency terms to 14.6 billion Danish kroner. Victoza dominates the global GLP-1 space with 60% market share in value terms. Increasing GLP-1 class volume should fuel Victoza’s growth. The GLP-1 segment’s global value share in the total diabetes market rose to 9.2% in August 2016 against a 7.7% share in August 2015.

In its LEADER trial, Victoza proved to reduce the cardiovascular risks in type 2 diabetic patients. Earlier, Eli Lilly’s (LLY) Jardiance had shown this benefit over other diabetes drugs. Novo’s other competitors in the space include Sanofi (SNY) and Merck (MRK).

Victoza in the US

Of the total diabetes care market, the GLP-1 class of drugs accounts for 11% in the US. Although there was fierce competition in the GLP-1 segment, Victoza managed to record strong volume growth. Its market share in the US GLP-1 class grew to 57%.

Victoza in Europe

Despite declining sales in the United Kingdom, Germany, and France, Victoza’s sales in Europe grew by 1% in local currency terms over the nine-month period. Victoza’s value market share in Europe during the period was 68% where the GLP-1 class accounts for 9% of the total diabetes care market.

Victoza in international operations

Victoza’s sales from international operations rose 29% in local currency over the nine-month period. In its International Operations segment, GLP-1 segment holds 3% of the total diabetes care market, whereas Victoza’s value market share in the region stood at 81%.

Victoza in China

Victoza recorded robust 24% sales growth in China where in value terms GLP-1 class presents just 0.9% of total diabetes care market.

Victoza in the Pacific

In local currency terms, Victoza’s sales grew 19% over the nine-month period. The continued growth of the GLP-1 class in Japan was one of the major drivers behind such sales growth. In Canada, there was positive GLP-1 market development.

If you want exposure to Novo’s wider diabetes portfolio, you can invest in the PowerShares International Dividend Achievers Portfolio (PID). PID holds 0.85% of its assets in Novo.

Let’s have a look at Tresiba, Novo’s growth driver of new-generation insulin in the next article.