How Did Phillips 66’s Marketing Segment Perform in 3Q16?

Phillips 66’s adjusted EBITDA from its Marketing segment fell 22% from 3Q15 to $429 million in 3Q16 due to weaker marketing margins and lower volumes.

Nov. 25 2016, Updated 10:04 a.m. ET

Phillips 66’s marketing segment

Phillips 66’s (PSX) adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) from its Marketing segment fell 22% from 3Q15 to $429 million in 3Q16 due to weaker marketing margins coupled with lower volumes of fuel sold.

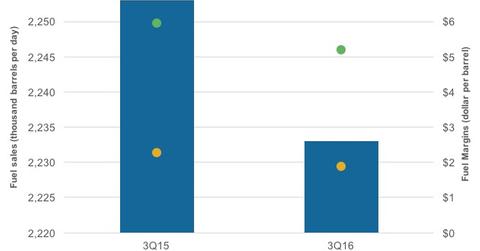

In 3Q16, volumes fell 1% from 3Q15 to 2,233 thousand barrels per day. PSX’s marketing margin fell YoY (year-over-year) in the US as well as in international regions 17% and 13%, respectively, to $1.8 per barrel and $5.2 per barrel, respectively, in 3Q16.

Peers’ marketing segments

In 3Q16, Marathon Petroleum (MPC) saw a 14% fall in its marketing segment’s income from operations to $209 million. This was due to lower margins on the sale of gasoline and distillates, partially offset by a rise in sales volumes of these products.

Notably, for exposure to refining stocks, investors can consider the iShares North American Natural Resources ETF (IGE). The ETF has ~7% exposure to refining and marketing sector stocks.