Jim Chanos on Tesla: ‘We Think the Equity Is Worthless’

Jim Chanos, a prominent short seller, discussed his view on Tesla in a recent interview with CNBC. He has a short bet on Tesla (TSLA) and said, “we think the equity is worthless.”

Nov. 20 2020, Updated 12:33 p.m. ET

Jim Chanos on Tesla

Jim Chanos, a prominent short seller, discussed his view on Tesla in a recent interview with CNBC. He has a short bet on Tesla (TSLA) and said, “we think the equity is worthless.”

He has been shorting Tesla for a long time. He was not confident about Tesla’s business model and its various products. Last year in an interview with CNBC in September 2016, he said that the proposed Tesla-SolarCity Merger is ‘crazy.‘ According to him, SolarCity’s (SCTY) business model isn’t economical. He said in the recent interview, “Let’s just say Tesla and Mr. Musk have a broad interpretation of the truth. There have been all kinds of announcements that this company has made…that turned out not to be true.”

Tesla’s performance

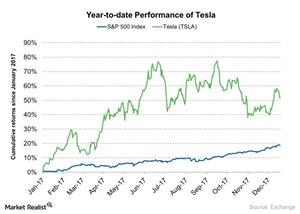

Tesla has given a strong performance so far this year. The stock returned nearly 54% on a year-to-date basis as of December 20, 2017. In the last one year, the stock reached $329 from $213.3 in December 2016. However, Chanos said, “To me, where the stock is now is not the story. I don’t care that it came from $30 or $200 or $300. That’s just meaningless.” The broader market S&P 500 Index (SPX-INDEX) (SPY) has returned 19.8% on a year-to-date basis as of December 20, 2017.

In the next part of this series, we’ll analyze Jim Chanos’s view on Netflix.