What You Should Know about Master Limited Partnerships

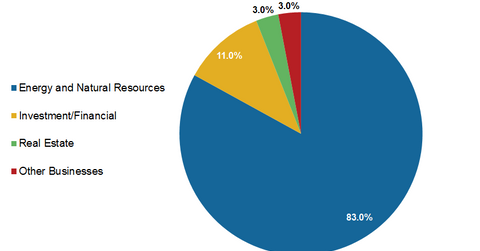

The number of MLPs has risen from a mere 32 in 2003 to 117 as of November 2016. 83% of total MLPs are energy and natural resources–related.

Nov. 28 2016, Published 3:22 p.m. ET

Overview of MLPs

Master limited partnerships (or MLPs) are publicly traded partnerships that trade on major US stock exchanges. MLPs pay no income tax at the partnership level.

Unlike most partnerships, MLPs are public companies, trading on major stock exchanges and filing documents such as 10-Ks, 10-Qs, and reports of material changes with the Securities and Exchange Commission (or SEC).

The number of MLPs has risen from a mere 32 in 2003 to 117 as of November 2016. 83% of total MLPs are energy and natural resources–related.

Criteria for MLPs

According to Internal Revenue Services, at least 90% of an MLP’s revenue must come from qualified services in order for it to operate as an MLP. Qualified services include the following:

- natural resource activities

- interest, dividends, rental income, and capital gains from real estate properties

- income from commodity investments

Regular income

MLPs, which pay out the majority of their cash flows to investors as distributions, could be a good investment option for those interested in regular income.

Investors can gain exposure to MLPs by buying individual MLP stocks such as Enterprise Products Partners (EPD), Energy Transfer Partners (ETP), and Williams Partners (WPZ) or through funds tracking broader portfolios of MLPs such as the Alerian MLP ETF (AMLP) and the JPMorgan Alerian MLP ETN (AMJ). We’ll cover alternate methods of investing in MLPs later in the series.