Analysts’ Recommendations for Halliburton

On June 12, 92% of the analysts tracking Halliburton rated it as a “buy,” ~3% of the analysts rated it as a “sell,” and the other 5% rated it as a “hold.”

June 16 2017, Updated 7:36 a.m. ET

Analysts’ recommendations for Halliburton

In this part, we’ll look at Wall Street analysts’ recommendations for Halliburton (HAL) on June 12, 2017.

Analysts’ rating for Halliburton

On June 12, 92% of the analysts tracking Halliburton rated it as a “buy” or some equivalent. Approximately 3% rated it as a “sell” or some equivalent, while the other 5% of the analysts rated it as a “hold.” In comparison, ~57% of the analysts tracking TechnipFMC (FTI) rated it as a “buy” or some equivalent on June 12.

Analysts’ rating changes

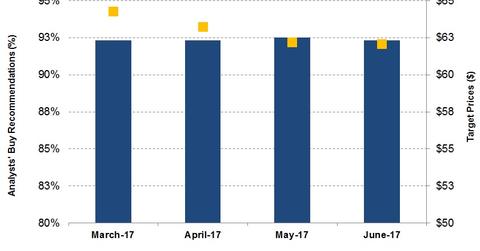

From March 12, 2017, to June 12, 2017, the percentage of analysts recommending a “buy” or some equivalent for Halliburton remained unchanged at 92%. Analysts’ “hold” and “sell” recommendations also didn’t change during the same period. A year ago, ~88% of the sell-side analysts recommended a “buy” for Halliburton. Halliburton accounts for 2.4% of the iShares North American Natural Resources ETF (IGE). IGE has remained nearly unchanged in the past year—compared to a 1% rise in Halliburton’s stock price.

Analysts’ target prices

On June 12, Wall Street analysts’ mean target price for Halliburton was $62.1. Currently, Halliburton is trading at ~$45, which implies ~38% upside at its current median price. A month ago, analysts’ average target price for Halliburton was ~$62.2.

The mean target price, surveyed among sell-side analysts, for Core Laboratories (CLB) is $123.5. Currently, Core Laboratories is trading at ~$107, which implies ~16% upside at its average target price. The mean target price, surveyed among sell-side analysts, for Baker Hughes (BHI) is ~$66.8. Currently, Baker Hughes is trading at ~$57, which implies ~19% upside at its mean target price.

To learn more about the OFS industry, read The Oilfield Equipment and Services Industry: A Primer.