What Are the Different Types of Coal?

Coal types differ from each other as a result of the difference in their organic matter content and maturity.

Feb. 9 2016, Published 2:41 p.m. ET

Fundamental characteristics of coal

Coal types differ from each other as a result of the difference in their organic matter content and maturity. The key differentiating factors include grade, type, and rank.

Grade

The grade is a measure of the relative percentage of organic matter to the mineral components based on a range of impurities like ash and moisture content. The greater the ash and moisture content in coal, the lower its grade.

Type

The type represents the various organic constituents called macerals. As per the American Society for Testing and Materials (or ASTM), macerals are grouped into three main subdivisions: vitrinite, liptinite, and inertinite. This classification helps in determining the volatility of coal.

Volatile matter includes substances other than moisture that are liberated in the form of gas or vapor during combustion of coal. Volatile matter helps in reducing unburnt carbon during the combustion process.

Rank

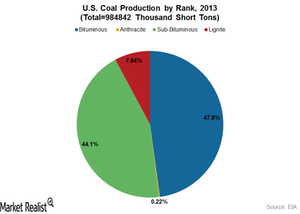

Rank represents the degree of metamorphism or coalification undergone by coal as it matures from peat to anthracite. Coalification is the process of compression and hardening of plant material over a long duration of time under the earth’s surface. Coal is an end product of the coalification process. Major categories of coal from lowest to highest rank are lignite, sub-bituminous, bituminous, and anthracite.

Of all coal types, anthracite has the highest carbon content of 86% to 97%, and is used as the principal raw material in preparation of steel. According to the EIA, bituminous coal has the widest range of carbon content of 45% to 86%. Bituminous coal, sub-bituminous, and lignite are chiefly used in electricity generation.

Major coal mining (KOL) companies like Peabody Energy (BTU), Arch Coal (ACIIQ), Alpha Natural Resources (ANRZQ), and Walter Energy (WLTGQ) mine both metallurgical and thermal coal. Cloud Peak Energy (CLD) concentrates its operations in extracting thermal coal.

In the next part of this series, we’ll look at the geographic distribution of different types of coal across the United States.