Can a Rate Hike Affect the Performances of Emerging Market Bonds?

In her speech at the Jackson Hole Economic Symposium, Fed chair Janet Yellen expressed optimism about another rate hike in the United States.

Nov. 11 2016, Updated 1:04 p.m. ET

BUTCHER: One last question: what effect would you see higher rates in the U.S. having on emerging markets debt?

RODILOSSO: It depends very much on the timing, the path, and the expectations surrounding a U.S. rate hike. If we associate higher rates in the U.S. with a stronger dollar, obviously EM local currency may suffer in the short term. If we experience higher rates in the U.S. and assume that some of the dollar strength has already been priced in, that might indicate that there is more global growth than expected and therefore higher commodity prices. This is a great scenario for EM fundamentals overall and may help some of the local currencies to perform relatively well. This is certainly also positive for EM from a credit perspective. I think you have to be wary of market technicals at times, and in the very near term, that may include an interest rate hike that the market may not be expecting, or the Fed coming out with a new predicted path that pushes the market adjust expectations higher. This may cause a technical selloff, which as a long-term EM investor, we like to see, because it is an opportunity to come in where fundamentals on a relative basis are improving, and you have the potential to identify some good values.

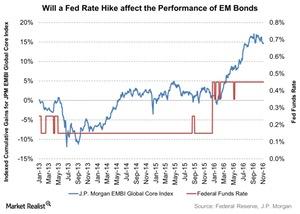

Market Realist – Rate hike’s effect on emerging market bonds

The Federal Reserve’s decision to hold off on rate hikes throughout 2016 helped certain emerging market currencies perform better, which was a major contributor to higher returns for emerging economies (EEM) in 2016. In her speech at the Jackson Hole Economic Symposium, Fed chair Janet Yellen expressed optimism about another rate hike in the United States. The Fed, however, kept the interest rate unchanged in September, with the expectation of a possible hike in December.

Uncertainty surrounding a rate hike doesn’t stop emerging market (or EM) bonds from outperforming other asset classes. Demand for EM bonds (EMLC) (HYEM) is expected to continue for the rest of 2016, mainly due to the higher yields offered by EM bonds compared to the remarkably lower yields offered by their developed market (IHY) counterparts.

Investors with appetites for higher risk seeking higher yield opportunities may want to consider exposure to emerging market bonds.