Morningstar: Using Economic Moat to Assess Stocks

The concept of economic moat is the basis of Morningstar’s assessment of a company’s (KO)(ORCL) long-term investment potential.

Nov. 1 2016, Updated 1:04 p.m. ET

Fair Value Represents A Company’s Long-Term Intrinsic Value

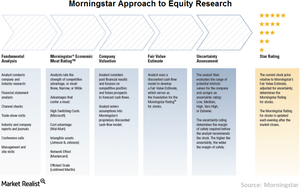

Another key component to Morningstar’s moat-investing equity research approach is its valuation process. Morningstar equity analysts assign a fair value estimate to each company based on how much cash it believes the company may generate in the future. The fair value represents a company’s long-term intrinsic value. Of course, stocks may trade above or below the company’s underlying fair value. The key is to identify those companies that are attractively priced at the time of investment.

Market Realist – The concept of economic moat is the basis for stock assessment

As we saw earlier in this series, the concept of economic moat is the basis of Morningstar’s assessment of a company’s (KO)(ORCL) long-term investment potential. However, Morningstar also uses the concept to estimate a company’s fair value. Morningstar uses its proprietary valuation methodology to select the most undervalued economic moat stocks (HOG) for inclusion in the Morningstar moat indexes (MOAT) (MOTI). Morningstar believes undervalued stocks can offer substantial future gains.

Market Realist – Cash flow generation

Morningstar uses future cash generation to arrive at a company’s fair value estimation. It believes a company that generates higher cash flows for an extended period should be rated higher than a company that isn’t generating enough cash. Therefore, economic moat is the differentiating factor when evaluating companies with similar growth rates or returns on invested capital.

After arriving at a company’s fair value estimation, Morningstar identifies stocks trading at a premium or discount to their intrinsic value. Stocks rated as one star trade at a premium to their intrinsic value while stocks rated as five stars trade at a discount to their fair value.