Where Is the Gold-Palladium Spread Headed?

The gold-palladium spread has seen its ups and downs over the past few months. But the United Kingdom’s Brexit vote resulted in some strength for palladium.

Oct. 26 2016, Published 10:01 a.m. ET

Gold-palladium ratio

Precious metal prices are facing headwinds from South Africa. The South African rand is falling significantly since the country’s finance minister appears to be facing imminent dismissal.

Palladium has seen a year-to-date rise of 13.6%, which is higher than the rise for platinum. In the past 30 trading days, palladium has fallen 9.5%.

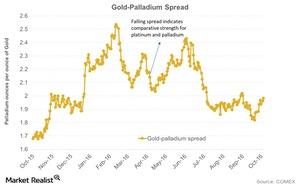

The above graph shows gold’s performance compared to palladium’s by way of the gold-palladium spread, or the gold-palladium ratio. The spread measures the number of palladium ounces it takes to buy a single ounce of gold. The higher the ratio, the weaker palladium is compared to gold, as more ounces of palladium are needed to buy a single ounce of gold.

Spread movements

The gold-palladium spread has seen its ups and downs over the past few months. But the United Kingdom’s Brexit vote resulted in some strength for palladium, which was evident in falling cross-commodity rates.

Once again, palladium is overtaking gold. The spread fell substantially after July 2016. Remember, a rise in the gold-palladium spread indicates strength for gold, while a fall indicates strength for palladium.

RSI levels

The gold-platinum spread was approximately 2.0 on October 24, 2016. Its RSI (relative strength index) was 59. An RSI level above 70 indicates that an asset has been overbought and could fall. An RSI level below 30 indicates that an asset has been oversold and could rise.

Fluctuations in these precious metals are closely reflected in funds such as the ETFS Physical Palladium (PALL) and the Merk Gold ETF (OUNZ). The precious metal mining companies that have fallen in the past month include AuRico Gold (AUQ), Alamos Gold (AGI), Kinross Gold (KGC), and Harmony Gold Mining (HMY).