Did Occidental Petroleum Set a High Bar for 3Q16 Production?

For 3Q16, Occidental Petroleum expects its total production from ongoing operations to be in the range of 600–605 Mboe per day.

Dec. 4 2020, Updated 10:53 a.m. ET

Occidental Petroleum’s production guidance for 3Q16

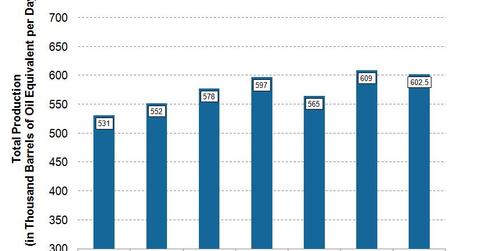

For 3Q16, Occidental Petroleum (OXY) expects its total production from ongoing (or core) operations to be in the range of 600–605 Mboe (thousand barrels of oil equivalent) per day. The midpoint of the 3Q16 production guidance would be 602.5 Mboe per day, which is ~4% higher than the company’s production of 578 Mboe per day in 3Q15. Sequentially, Occidental Petroleum’s production guidance would be ~1% lower than in 2Q16.

OXY’s higher year-over-year production guidance for 3Q16 can be attributed to the higher production from Al Hosn Gas, which was not fully operational in 3Q15, and its ramp-up of production levels for natural gas (UNG) from Oman’s Block 62, which commenced production in 2016.

Occidental Petroleum’s ongoing (or core) assets exclude assets that OXY divested, exited, or is in the process of exiting. These assets include Williston (sold in 4Q15) and Piceance (sold in 1Q16) in the US and assets in Iraq, Yemen, Bahrain, and Libya in the Middle East and North Africa regions. Abu Dhabi, Oman, Qatar, Colombia, and the US Permian Basin and South Texas locations remain among OXY’s core assets.

Notably, upstream companies Energen (EGN), Diamondback Energy (FANG), and Pioneer Natural Resources (PXD) are also active in Permian Basin.

Updated 2016 production guidance

Due to its strong start in 1H16, increases in production from Al Hosn and Block 62 and strong YoY (year-over-year) production growth from Permian Resources, Occidental Petroleum now expects 2016 production from its ongoing (or core) operations to be in the range of 590–600 Mboe per day. This new 2016 production guidance is at the high end of its previous growth guidance range of 4%–6%.

Occidental Petroleum plans to achieve this increased production without any changes in its original capital program of ~$3 billion, mainly as a result of better-than-expected production from domestic operations. In 1H16, Occidental Petroleum spent $1.4 billion in capital expenditure.