A Look at Morgan Stanley’s Top 5 ‘Secular Growth’ Stock Picks

On Friday, October 14, 2016, Morgan Stanley (MS) released a list of its favorite “secular growth” stock picks. It believes these stocks have long-term growth possibilities.

Oct. 19 2016, Updated 12:04 p.m. ET

Morgan Stanley’s view on technology stocks

On Friday, October 14, 2016, Morgan Stanley (MS) released a list of its favorite “secular growth” stock picks. It believes these stocks have long-term growth possibilities and can provide handsome returns even in tough economic (QQQ) (SPY) times.

On Thursday, October 13, 2016, the firm’s research team wrote in a note to its clients, “In this refresh of our annual ‘Secular Growth Stocks’ report, we highlight 30 stocks that we believe can grow strongly even if the global economy grows more slowly than our current GDP forecasts. We believe these companies all have exposure to longer-term growth drivers, such as a sustainable competitive advantage, a multi-year product cycle, market share gains, or pricing power.”

Top stock picks

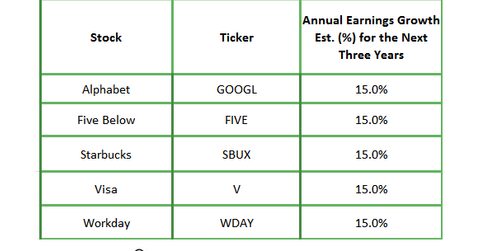

Below are Morgan Stanley’s top five “secular growth” stock picks:

According to Morgan Stanley (MS), these stocks will perform better in the next year. It chose these stocks based on their past performances and expectations for future revenue growth. In the past 12 quarters, these stocks have had positive revenue growth, and for the next three years, their estimated earnings growth could be at least 15.0%.

In the rest of this series, we’ll take an individual look at each of the above stocks. Let’s start by looking at Workday (WDAY).