Kellogg Declares Dividend of $0.52 per Share

Price movement Kellogg (K) has a market cap of $26.0 billion. It rose 0.15% to close at $74.34 per share on October 21, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -1.5%, -5.0%, and 4.9%, respectively, on the same day. K is trading 2.6% below its 20-day moving average, 5.9% below […]

Oct. 25 2016, Updated 8:06 a.m. ET

Price movement

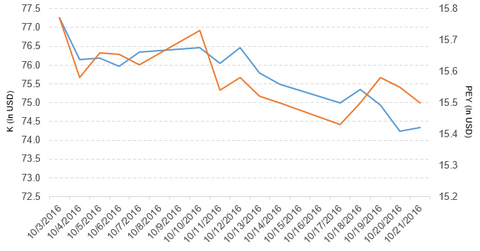

Kellogg (K) has a market cap of $26.0 billion. It rose 0.15% to close at $74.34 per share on October 21, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -1.5%, -5.0%, and 4.9%, respectively, on the same day. K is trading 2.6% below its 20-day moving average, 5.9% below its 50-day moving average, and 2.8% below its 200-day moving average.

Related ETF and peers

The PowerShares High Yield Equity Dividend Achievers Portfolio ETF (PEY) invests 1.5% of its holdings in Kellogg. The ETF aims to tracks a yield-weighted index of US companies that have increased their annual dividends for at least ten consecutive years. The YTD price movement of PEY was 19.5% on October 21.

The market caps of Kellogg’s competitors are as follows:

Kellogg declares dividend

Kellogg has declared a regular dividend of $0.52 per share on its common stock. The dividend will be paid on December 15, 2016, to shareholders of record at the close of business on December 1, 2016.

Performance of Kellogg in 2Q16

Kellogg reported 2Q16 net sales of $3.3 billion, a fall of 5.7% over the $3.5 billion reported in fiscal 2Q15. Sales from its US morning foods, US snacks, North America Other, Europe, Latin America, and Asia Pacific segments fell 2.0%, 3.8%, 7.5%, 3.2%, 37.8%, and 2.6%, respectively, between 2Q15 and 2Q16. Sales from its US specialty segment rose 0.37% in the same period. The company’s cost of goods sold as a percentage of its net sales fell 5.2%, and its operating profit rose 9.0%.

Its net income and EPS (earnings per share) rose to $280.0 million and $0.79, respectively, in fiscal 2Q16, compared with $223.0 million and $0.63 in fiscal 2Q15. Kellogg’s cash and cash equivalents rose 111.6%, and its inventories fell 2.7% between fiscal 4Q15 and fiscal 2Q16. Its current ratio and long-term debt-to-equity ratio rose to 0.65x and 3.1x, respectively, in fiscal 2Q16, compared with 0.56x and 2.5x in fiscal 4Q15.

Projections

The company has made the following projections for 2016:

- currency-neutral comparable EPS of $4.11–$4.18

- currency-neutral comparable operating profit growth of 15.0%–17.0% due to the timing of price actions in its Venezuelan business

- currency-neutral comparable net sales growth of 4%–6%

- cash flow of ~$1.1 billion

Next, let’s take a look at Procter & Gamble (PG).