How BNSF’s Carloads Compared to Rival Union Pacific

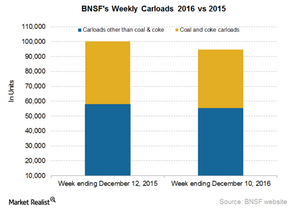

BNSF Railway’s (BRK-B) total railcars for the week ended December 10, 2016, fell 5.5% to ~95,000 units, compared to ~100,000 units on a year-over-year basis.

Nov. 20 2020, Updated 1:21 p.m. ET

BNSF’s carloads

BNSF Railway (BRK-B) operates in the Western United States, competing with Union Pacific (UNP). Its total railcars for the week ended December 10, 2016, fell 5.5% to ~95,000 units compared to ~100,000 units on a year-over-year basis.

Carloads other than coal and coke fell 4.6% to ~55,000 railcars in the week ended December 10, 2016, from 58,000 railcars in the corresponding week of 2015. In our reported week, the percentage fall in BNSF’s overall carloads was almost equal to the percentage fall reported by rival UNP.

To compare this week’s traffic data with the previous week, please refer to Freight Rail Traffic for the Week Ended December 3.

Why coal matters to BNSF

BNSF Railway’s coal and coke railcars fell 6.6% in the week ended December 10, 2016, on a year-over-year basis. For UNP, the fall in the same category was 10.6%.

Coal transportation contributed nearly 22.0% of freight revenues in 2015 for BNSF, the Berkshire Hathaway–controlled largest US Class I railroad. Nearly 90.0% of its coal tons originate from the Powder River Basin in Wyoming and Montana.

Major coal producers operating in that area include Alpha Natural Resources (ANR) and bankruptcy-declared Peabody Energy (BTU). Overall, environmental concerns and competition from natural gas (UGAZ) have hampered incremental coal shipment prospects for coal producers (ARLP) in 2016.

Progressing and regressing commodity groups

Below are the main front runner commodities for the week ended December 10, 2016:

- motor vehicles

- food

- farm (no grain)

- grain mill

Below are the commodities that witnessed a backward movement:

- petroleum

- metallic ores

- waste and scrap

- forest products

- non-metallic minerals

For more information on US major railroad stocks, visit Market Realist’s railroads page.

In the next part, we’ll look at the details of BNSF Railway’s intermodal traffic.