Why Has China’s Risk Ranking Fallen?

Movers and shakers…and losers The biggest movers in our latest quarterly update? China posted the biggest rankings decline, with a three-notch fall to the 32nd place. This was mostly a result of shuffles of its close neighbors in the index. China’s Financial Sector Health score slumped against a backdrop of rapid credit growth. Norway was […]

Oct. 5 2016, Published 4:49 p.m. ET

Movers and shakers…and losers

The biggest movers in our latest quarterly update? China posted the biggest rankings decline, with a three-notch fall to the 32nd place. This was mostly a result of shuffles of its close neighbors in the index. China’s Financial Sector Health score slumped against a backdrop of rapid credit growth.

Norway was another notable mover. Its score declined as falling oil revenues eroded its fiscal surplus, but the country remains the leader of the BSRI pack in rankings terms.

Venezuela, already at the bottom of the index, posted the largest score decline. Its scores fell across all four BSRI metrics on falling growth projections, weak oil prices, and poor government effectiveness.

Market Realist: warning signs in China

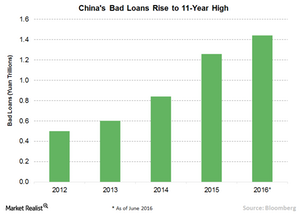

China’s three-notch fall was mainly triggered by various headwinds that affected its economy. China has experienced a huge increase in its debt level since the global financial crisis, adding to concerns over its financial stability. Based on an analysis from the Bank of International Settlements, China’s credit-to-GDP gap is at 30%—much higher than the 10% threshold set by the bank.

China’s rate of investment is also very high, at around 50% of GDP. The diminishing rate of return on the incremental investment is an area of acute concern for the economy. For 2015, China’s debt-to-GDP ratio stood at 243% while Fitch estimates China’s bad loans at 21% of its total loans. China’s ten-year government bond (BWX) (ISHG) (BWZ) currently yields ~2.8%, which is just below its high of 3% recorded in June.

Norway’s fiscal prudence

Norway is facing different problems from China. Declining oil prices have led Norway to experience its first budget deficit in 20 years in the second quarter of 2016. The government’s total revenue plunged 2.3% to $40 billion, while total expenditures increased by 8% to $40.6 billion, which incurred a deficit of $0.6 billion. The slump in oil prices also resulted in a loss of almost 40,000 jobs, mainly in the oil and gas industry, while unemployment reached a high of 5%.

However, early efforts from the government steered the economy out of further trouble. Norway is now likely to avoid negative interest rates, while the GDP is expected to grow at 1.8% next year. As a result, the country remains at the top of the BSRI ranking, despite its falling score.

Venezuela’s woes

The sharp decline in oil prices has severely affected Venezuela’s oil-driven economy. The country’s economy is shrinking at a rate of 8% per annum—the worst rate globally. Inflation has reached 700% while the IMF (International Monetary Fund) projects it will cross 1,600% in 2017.

Amid the crisis, Venezuelan bonds (IAGG) (IGOV) have sunk to a new low, while the yield has surged to a record high. According to Datastream, Venezuelan dollar bonds on average have returned an impressive 14.1% so far this year. However, with the current economic crisis, Venezuelan bonds’ risk-reward ratio seems to be unfavorable. No wonder Venezuela’s BSRI score has experienced the largest decline in the world.