What Do Analysts Recommend for Abbott Laboratories in January?

The 12-month consensus analyst recommendation for Abbott Laboratories on January 18 is a “buy.”

Jan. 22 2019, Updated 2:05 p.m. ET

Stock price movements

On January 17, Abbott Laboratories (ABT) closed at $70.52. On January 17, Abbott Laboratories’ market capitalization was $123.41 billion. The company closed at a premium of 26.88% as compared to its 52-week low price of $55.58 and at a discount of 5.87% as compared to its 52-week high price of $74.92. The company is trading at a trailing PE ratio of 53.42x and a forward PE ratio of 22.04x.

Based on its closing price on January 17, the company reported returns of 2.08% in the last week, 1.10% in the last month, and -0.61% in the last quarter. Abbott Laboratories also reported returns of 8.91% in the last half year, 19.55% in the last year, and -2.50% YTD.

Similar to Johnson & Johnson (JNJ), Abbott Laboratories has underperformed the broader market, represented by the SPDR S&P 500 ETF in 2019 YTD. However, unlike Johnson & Johnson, the company managed to perform better than SPY for most of 2018.

Based on its closing price on January 17, the broader healthcare market, represented by the Health Care Select Sector SPDR ETF (XLV), reported returns of 1.71% in the last week, 2.10% in the last month, and -4.20% in the last quarter. XLV also reported returns of 1.83% in the last half year, 1.06% in the last year, and 2.90% YTD. Abbott Laboratories has underperformed XLV in 2019 YTD but managed to significantly outperform the ETF in 2018.

Analysts’ recommendations and target price for Abbott Laboratories

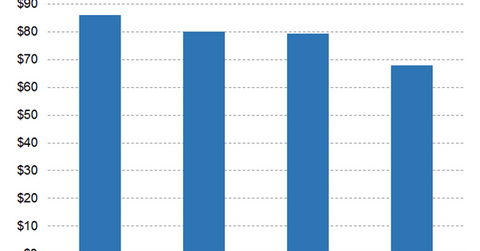

The 12-month consensus analyst recommendation for Abbott Laboratories on January 18 is a “buy.” The 12-month consensus target price for the company is $79.47, which is 12.69% higher than its last closing price on January 17. The highest target price estimate for the company is $86, and the lowest target price estimate is $68.

Out of the 22 analysts covering Abbott Laboratories on January 17, eight analysts have rated the company as a “strong buy,” 11 analysts have rated the company as a “buy,” two analysts have rated the company as a “hold,” and only one analyst has rated the company as a “strong sell.”

In the next article, we’ll compare revenue trends of Johnson & Johnson and Abbott Laboratories.