Your Outliers in the Consumer Space: 5th Week of August

By the end of August, the S&P Consumer Staples had outperformed the S&P Consumer Discretionary and SPY with respective returns of 0.89%, -0.18%, and 0.50%.

Dec. 4 2020, Updated 10:52 a.m. ET

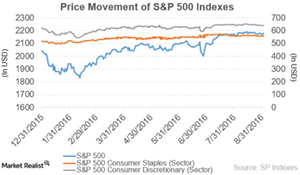

Price movement of S&P 500 indexes

By the end of the fifth week of August 2016, the S&P Consumer Staples had slightly outperformed the S&P Consumer Discretionary and the S&P 500 as a whole. The indexes had respective returns of 0.89%, -0.18%, and 0.50%.

The S&P Consumer Staples stocks had a month-to-date return of 0.72%. That’s much higher than 0.33% and 0.42%, from the S&P Consumer Discretionary and the S&P 500, respectively.

The Consumer Staples Select Sector SPDR Fund (XLP) tracks a market-cap-weighted index of consumer staples stocks drawn from the S&P 500. XLP is the ETF of consumer goods.

Last week’s updates from the consumer sector

The key consumer sector updates for the fifth week of August 2016 are as follows:

- Campbell Soup (CPB) announced its fiscal 2016 results and a quarterly dividend of $0.35 per share.

- G-III Apparel Group (GIII) declared its results for fiscal 2Q17 and projection for fiscal 2017.

- Cooper Tire & Rubber (CTB) appointed a new president and chief executive officer.

- Fossil Group (FOSL) will now ship smartwatches based on Qualcomm Technologies.

- Newell Brands (NWL) announced new appoint and its participation in Global Consumer Staples Conference.

- PepsiCo (PEP) announced the launch of Organic Gatorade.

- Canon (CAJ) introduced new cameras.

- Procter & Gamble (PG) started the exchange offer for its separated brands.

- Sony (SNE) announced new products for its future growth.

- B&G Foods (BGS) will be present in Global Consumer Staples Conference on September 7.

- Leggett & Platt (LEG) will discuss TSR framework, longer-term financial targets, and opportunities on September 14.

In this series, we’ll take a look at the above stocks’ performances, price movements, and latest quarterly results.

Let’s start with Campbell Soup (CPB).