Which Fast Food Restaurants Do Analysts Favor?

Jack in the Box (JACK) and Restaurant Brands International (QSR) are analysts’ favorites among the companies we’ve reviewed in this series.

Dec. 4 2020, Updated 10:53 a.m. ET

Analyst recommendations

Share prices generally move in tandem with analyst recommendations. If analysts raise their next-12-month target prices, stock share prices may also increase, and vice versa.

In this final part of our series, we’ll discuss analysts’ revised estimates and recommendations for fast food restaurants after these companies’ 2Q16 results. The companies considered for review are expected to return 14.7% in the next 12 months on average.

Peer comparisons

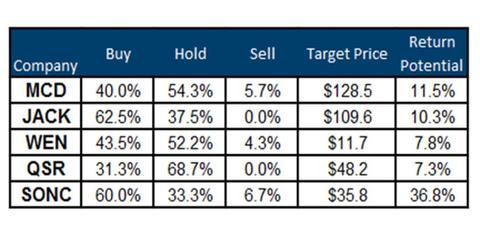

Jack in the Box (JACK) and Restaurant Brands International (QSR) are analysts’ favorites among the companies we’ve reviewed in this series. These stocks don’t have any “sell” recommendations. 62.5% of the analysts recommended a “buy” for JACK, while 37.5% recommended a “hold.” For QSR, 31.3% recommended a “buy,” while 68.8% recommended a “hold.”

In comparison, 43.5% of analysts recommended a “buy” for Wendy’s (WEN), while only 4.3% recommended a “sell.” Sonic (SONC) and McDonald’s (MCD) were the least favored stocks with 6.7% and 5.7% of the analysts giving “sell” recommendations.

Return potential

Although Sonic’s (SONC) share price has fallen by over 26% since the beginning of 2Q16, analysts are expecting SONC’s share price to reach $35.8 in the next 12 months, which represents a return potential of 36.8%. SONC is followed by McDonald’s (MCD) with a return potential of 11.5%. MCD forms 4.3% of the SPDR Dow Jones Industrial Average ETF (DIA).

JACK, whose share price has appreciated by over 50% since the beginning of 2Q16, is expected to further appreciate by 10.3%. During the same period, WEN and QSR are expected to yield smaller returns of 7.8% and 7.3%, respectively.

In the end, we should note that a share price that is lower than a stock’s target price doesn’t necessarily mean that the stock is an automatic “buy.” Before investing, investors should carefully analyze the various metrics that we’ve discussed in this series.