Weekly Nitrogen Update: Anthracite Prices Fell in China

For the week ending September 9, average weekly anthracite coal prices in China fell 4.2% to $81.1 per metric ton—compared to the previous week.

Sept. 13 2016, Updated 10:04 a.m. ET

Coal used for nitrogen

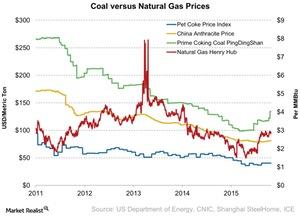

In contrast to natural gas–based nitrogen fertilizer producers in North America, producers in China primarily use coal as an input source to produce nitrogen fertilizers. China is the world’s biggest urea exporter—it’s impacted by price movements in coal. Let’s look at how coal prices traded for the week ending September 9.

The commodities in the above chart are key hydrogen sources for nitrogen fertilizers. Their price movements directly or indirectly impact fertilizer producers’ profitability such as CF Industries (CF), Terra Nitrogen (TNH), CVR Partners (UAN), and PotashCorp (POT).

China anthracite prices fell

For the week ending September 9, average weekly anthracite coal prices in China fell 4.2% to $81.1 per metric ton—compared to the previous week. On average, anthracite coal prices in China have fallen by 4% year-over-year. This isn’t as steep compared to the price decline at the Henry Hub, as we saw earlier in this series.

During this week, the Chinese yuan strengthened by 11 basis points compared to the US dollar. Due to this change, Chinese coal prices appear to have changed when converted to the dollar.

CVR Partners is based in North America (MOO). It uses pet coke—a coal-like substance—to produce nitrogen fertilizers. Weekly pet coke prices for the week ending September 9 fell to $40.5—unchanged from the previous week.

In the next part, we’ll discuss phosphorous fertilizers.