Why Did Treasury Bonds Record a Fall in Yield?

The yield on US ten-year Treasury securities fell below the 1.6% mark for the first time on September 26, 2016 due to a rise in demand.

Sept. 30 2016, Updated 6:04 p.m. ET

Flows into U.S. Treasury bonds have been more mixed. Nominal Treasury securities have had small net outflows, a big change from the large outflows they experienced leading up to the June Fed meeting. Meanwhile, Treasury Inflation-Protected Securities (or TIPS) had some inflows as investors position for potentially higher inflation down the road.

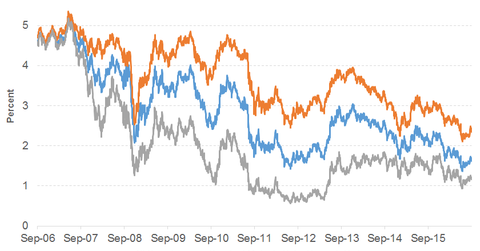

Market Realist –Treasury yield scaled new lows

The yield on US ten-year Treasury securities fell below the 1.6% mark for the first time on September 26, 2016, due to a rise in demand. The rise in demand for safe income was triggered by the fall in global equities. The ten-year government bond yields of Germany and Japan saw negative levels. The yields of government bonds in Switzerland, France, the United Kingdom, Sweden, and Denmark also fell.

Global stock prices were pushed down by apprehensions over the upcoming US presidential election and the health of Europe’s financial sector. Concerns in Europe persisted after the sell-off in Deutsche Bank AG as the stock prices for Germany’s largest lender fell on September 26, 2016.

The rally of Treasury bonds with longer maturities was driven by slack monetary policies of the United States and Japan, which are expected to continue. The fear of a Brexit further fueled the demand for safe investments, thereby preventing the Fed from raising interest rates.

Below are some year-to-date returns for ETFs: