How Volatile Is Superior Energy Services in 1Q17?

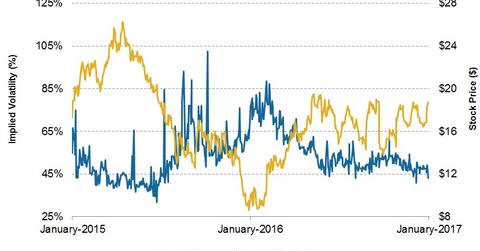

On January 6, SPN had an implied volatility of ~43%. Since SPN’s 3Q16 financial results on October 24, 2016, its implied volatility has fallen from 54%.

Jan. 12 2017, Updated 10:35 a.m. ET

SPN’s implied volatility

On January 6, 2016, Superior Energy Services (SPN) had an implied volatility of ~43%. Since SPN’s 3Q16 financial results were announced on October 24, 2016, its implied volatility has fallen from 54% to the current level.

What does implied volatility mean?

IV (implied volatility) reflects investors’ views of a stock’s potential movement. However, IV does not forecast direction. Implied volatility is derived from an option pricing model, and so investors should note that the correctness of an implied volatility suggested prices can be uncertain.

Helmerich & Payne’s (HP) implied volatility on January 6 was 31%, while Precision Drilling’s (PDS) implied volatility was 47% on that day. Tidewater’s (TDW) implied volatility was 131% on January 6.

Notably, SPN makes up 0.02% of the iShares Core Russell US Value ETF (IUSV). The energy sector makes up 12.9% of IUSV.

Remember, energy stocks are typically correlated with crude oil price. Has SPN’s correlation with the crude oil price risen? We’ll explore this further in the next part of the series.