RYU, FXU, and JXI: Will These Utility ETFs Outrun Utility Stocks?

The Guggenheim S&P 500 Equal Weight Utilities ETF (RYU) invests nearly 80% of its portfolio in US utilities and 20% in telecoms.

Sept. 16 2016, Updated 10:04 a.m. ET

Utility ETFs

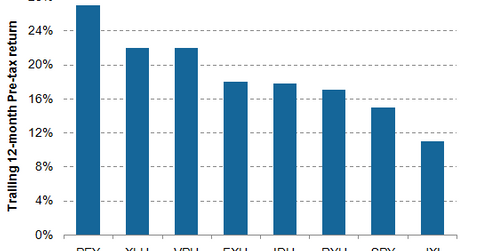

The chart below shows the relative total returns of utility ETFs. The Guggenheim S&P 500 Equal Weight Utilities ETF (RYU) invests nearly 80% of its portfolio in US utilities and 20% in telecoms. It yields near 3%.

The FirstTrust Utilities AlphaDEX Fund (FXU) also has a combination of US utilities and telecom stocks. It invests more than 35% in telecom stocks and the rest in utilities. The iShares Global Utilities Fund (JXI) gives exposure to global equities in the utilities industry. It has more than 55% exposure to US utilities and 40% exposure to European utilities.

The iShares US Utilities Fund (IDU) tracks the investment results of an index made up of US utility stocks. It holds 55 stocks from the sector.