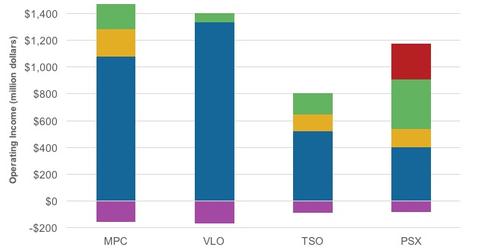

How PSX’s Operating Income Differs from Those of MPC, VLO, TSO

Refiners such as PSX, MPC, VLO, and TSO are now focusing on diversifying their earnings models to shield themselves from the volatile refining environment.

Sept. 6 2016, Updated 11:04 a.m. ET

PSX’s operating income

Refiners’ operating incomes are mainly derived from their core refining operations. However, refiners are now focusing on diversifying their earnings models to shield themselves from the volatile refining environment.

Phillips 66 (PSX) leads the pack, with just 37% of its operating income being derived from its refining segment. PSX derived 12% from its midstream segment, 34% from its marketing segment, 24% from chemicals, and -8% from corporate and others in 2Q16.

Tesoro (TSO) is second in line, with 72% of its operating income being derived from refining, 17% from midstream, 22% from marketing, and -12% from corporate and others.

Marathon Petroleum (MPC) has also diversified its operating model. It derives 15% of its operating income each from its midstream and marketing segments.

Valero Energy (VLO) mostly derives its operating income from its refining segment. The PowerShares Dynamic Large Cap Value ETF (PWV) has ~4% exposure to energy sector stocks.