What’s the Primary Driver of Corporate Earnings?

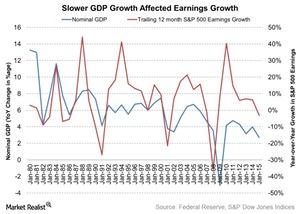

Nominal gross domestic product in the United States is strongly correlated with the trailing-12-month earnings growth of the S&P 500.

Sept. 15 2016, Updated 11:04 a.m. ET

Look for faster earnings and economic growth

If stocks are to advance further, sustainable gains need to be predicated on faster earnings growth. That, in turn, is a function of nominal GDP (or NGDP), real growth plus inflation. Looking back over the past 60 years, the level of NGDP has been strongly correlated with non-financial profit growth. During this period NGDP growth has explained roughly 20% of the variation in profit growth.

Market Realist – GDP and market earnings growth move together

As we can see in the above chart, nominal gross domestic product in the United States is strongly correlated with the trailing-12-month earnings growth of the S&P 500 (SPY) (IVV).

For the period between 1980 and 2016, the correlation between the two has been 0.20, which demonstrates that they move in the same direction. The lower the nominal GDP, the lower the trailing-12-month earnings growth for the S&P 500, and vice versa.

What drives the equity market?

One of the factors that drives the equity market is estimated corporate earnings growth. Corporate earnings can show growth if nominal GDP grows. Corporate earnings as a percentage of GDP need to trend upward for earnings growth to exceed GDP growth in the long term.

However, as the chart above depicts, there’s no trend in either earnings growth or GDP growth. This shows that the factors responsible for lower economic growth also form a boundary to earnings growth to some extent. What we can conclude here is that what drives economic growth also drives earnings and, ultimately, stock market performance (IWM).

How are inflation and stock returns related?

As we discussed above, growth in nominal GDP drives earnings growth and stock price returns. Nominal GDP takes into account the inflation factor.

Various studies have been conducted in efforts to understand the impact of inflation on stock returns. These studies have revealed that expected inflation could impact stock prices either positively or negatively depending on various factors. We’ll discuss this further in the last part of the series.

In the next article, we’ll see how the strong US dollar has posed headwinds for US companies’ revenue growths lately.