Performance of GSK’s Global Pharmaceuticals Franchises Mixed

The global pharmaceuticals franchise is GlaxoSmithKline’s (GSK) largest revenue contributor.

Sept. 13 2016, Updated 8:04 a.m. ET

Global pharmaceuticals

The global pharmaceuticals franchise is GlaxoSmithKline’s (GSK) largest revenue contributor. Global pharmaceuticals include various products like respiratory, cardiovascular, metabolic, urology, immuno-inflammation, and established products.

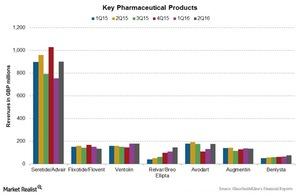

The global pharmaceutical franchise reported revenues of 3.0 billion pounds in 2Q16. The above chart shows revenues for some of its key products.

Performance of each franchise

- For the respiratory franchise, drugs Seretide and Advair are losing their market share to the generic competition. Overall, the respiratory franchise reported flat revenues of 1.6 billion pounds at constant exchange rates in 2Q16.

- For the cardiovascular, metabolic, and urology franchise, the drugs Duodart and Jalyn have seen strong performances, while Avodart, one of the key products of GSK, has been exposed to generic competition since October 2015. The franchise sales fell by 5% to 236 billion pounds at constant exchange rates during 2Q16.

- For the immuno-inflammation franchise, the new drug Benlysta is driving the growth. Benlysta sales improved by ~29%, while the franchise sales improved by 27% during 2Q16.

- Various products in the established products franchise are losing their market share to generic competition and reported a revenue fall of 14% at constant exchange rates during 2Q16 due to the lower sales across all markets.

The other pharmaceuticals franchise include some key products like Augmentin, Relenza, dermatology products, and rare disease products. The revenues for this franchise fell 11% at constant exchange rates during 2Q16 due to lower sales for Augmentin, dermatology products, and rare disease products, partially offset by the strong performance of Volibris.

Investors can consider the Schwab International Equity ETF (SCHF), which holds 0.7% of its investments in GlaxoSmithKline, 0.6% in AstraZeneca (AZN), 0.7% in Sanofi (SNY), and 0.6% in Novartis (NVS).