Why Is Copper Trading High in the Early Hours on September 14?

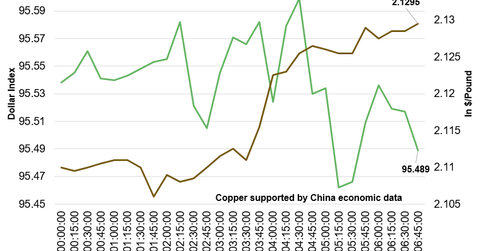

At 6:20 AM EST on September 14, the COMEX copper futures contract for December delivery was trading at $2.13 per pound—a gain of ~1.2%.

Dec. 4 2020, Updated 10:52 a.m. ET

Copper trades at three-week high

Copper started the week on a positive note. It gained on September 12, but lost momentum on September 13. Copper regained its strength in the early hours on September 14 and reached three-week high price levels. At 6:20 AM EST on September 14, the COMEX copper futures contract for December delivery was trading at $2.13 per pound—a gain of ~1.2%.

China’s economic data support copper prices

Copper prices are being supported by a string of better-than-expected Chinese economic data. China’s industrial production in August grew 6.3% year-over-year—the fastest growth in the past five months. This is better than the previous month’s growth of 6% and the market’s expectation of 6.1%. China’s fixed-asset investment for August grew 8.1%—compared to the same period in 2015. Following this data, the People’s Bank of China reported new loans data in the early hours on September 14. It reported a rise in new loans to 948.7 billion yuan in August. This is better than the market’s expectation of 750 billion yuan.

On September 13, major copper producers Freeport-McMoRan (FCX), Glencore (GLNCY), BHP Billiton (BHP), and Rio Tinto (RIO) fell 8.4%, 4.9%, 5.3%, and 4.2%, respectively. The SPDR S&P Metals & Mining ETF (XME) and the PowerShares DB Base Metals (DBB) fell 4.8% and 0.9%.

Gold and silver are stable in the early hours

After falling for five consecutive trading days, gold and silver are stable in the early hours on September 14. At 6:30 AM EST, the COMEX gold futures contract for December delivery was trading at $1,326.7 per ounce—a gain of ~0.23%. The COMEX silver futures contract for December delivery was trading at $19.14 per ounce—a gain of ~0.86%. The market is looking forward to the Fed’s meeting scheduled for next week. As of September 13, the chances of an interest rate hike in September, November, and December were at 15%, 22%, and 51.8%, respectively.