Will Novo Nordisk’s Core Capabilities Be Enough to Differentiate Its Research Pipeline?

Novo Nordisk’s search for new molecules through partnerships and other alliances has proven instrumental in strengthening its R&D pipeline.

Oct. 4 2016, Updated 8:04 a.m. ET

Core capabilities

Novo Nordisk’s (NVO) focus is on four strategic areas, and the company has managed to become a leader in three of these areas. This achievement can be attributed to the differentiated core capabilities that the company has leveraged in its research programs. Novo Nordisk’s search for new molecules through partnerships and other alliances has also proven instrumental in strengthening its R&D (research and development) pipeline.

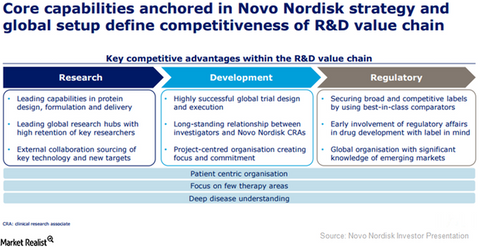

The implementation of targeted research programs is expected to translate into increased profitability for Novo Nordisk. The below diagram shows how Novo Nordisk’s core capabilities have strengthened the company’s R&D value chain, which has helped Novo Nordisk pose strong competition to peers like GlaxoSmithKline (GSK), Sanofi (SNY), and Eli Lilly (LLY).

Research stage

With its expertise in protein design, formulation, and delivery, Novo Nordisk has managed to synthesize stable insulin therapies. In addition to injectable therapies, the company is actively involved in developing oral therapies for diabetes and has created a broad network of research sites equipped with leading scientists.

Development stage

Novo Nordisk boasts of consistent performance in the effective design and implementation of clinical trials using in-house expertise. Unlike the majority of pharmaceutical companies, which generally outsource research programs to contract research organizations, in-house drug development enables Novo Nordisk’s clinical research associates to develop long-term relationships with other stakeholders in the drug approval process.

Regulatory stage

By involving the regulatory authorities at the preclinical stage of drug development, Novo Nordisk increases the probability of successful trial implementation.

Notably, the Vanguard FTSE All-World ex-US ETF (VEU) has about 0.34% of its total portfolio holdings in NVO.