Must-Know: Key Upcoming LNG Export Terminals in the US

The LNG sector faces steep competition not only from other domestic terminals but also other countries in the international LNG market.

Sept. 15 2016, Updated 8:05 a.m. ET

US natural gas production

With the rise in shale gas resources, there has been growth in US natural gas production. This has not only reduced the volume of natural gas imported but also encouraged exports to other countries.

The rise in the supply of natural gas resulted in a decline in its domestic prices. Due to a fall in natural gas prices in the US, there has been an increase in US exports.

LNG export

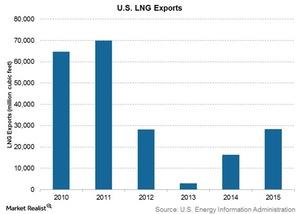

Many LNG (liquefied natural gas) terminals in the US are engaged in the development or expansion of new LNG export facilities. The authorization, setup, and construction of LNG export and import terminals is highly regulated by the Federal Energy Regulatory Commission (or FERC). The chart above shows the US LNG export numbers for the last six years.

The Sabine Pass liquefaction terminal by Cheniere Energy (LNG) in Louisiana is in the development phase. It plans to operate six liquefaction units and has a permitted capacity of 4.16 Bcfpd (billion cubic feet per day).

Some new LNG export terminals in the pipeline, apart from Dominion Midstream Partners’s (DM) Cove Point terminal, are:

- Cameron LNG Terminal, a project by Sempra Energy (SRE) in Louisiana, has a total capacity of 1.7Bcfpd. It is scheduled to begin service by 2018.

- Freeport LNG terminal in Texas has three trains under construction totaling 1.8 Bcfpd, with commercial operations expected from 2019 onward.

- An LNG terminal by Cheniere Energy in Corpus Christi, Texas, is under construction with a total capacity of 2.14 Bcfpd. It is scheduled to begin service in 2018.

Increased competition

The LNG sector faces steep competition not only from other domestic terminals but also other countries in the international LNG market. Australia has emerged as a global player in LNG exports, with a boom of several LNG terminals and its access to Asian markets.

Because the US is one of the world’s largest natural gas producers, it is expected to be among the biggest contributors to global LNG capacity.