Dominion Midstream Partners LP

Latest Dominion Midstream Partners LP News and Updates

What’s in Store for Dominion Energy Stock?

Dominion Energy (D), one of the laggards among top utilities this year, seemed strong lately and is currently trading close to an eight-month high.

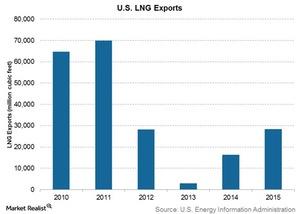

Must-Know: Key Upcoming LNG Export Terminals in the US

The LNG sector faces steep competition not only from other domestic terminals but also other countries in the international LNG market.