Key Highlights of Apache’s Alpine High Resource Play

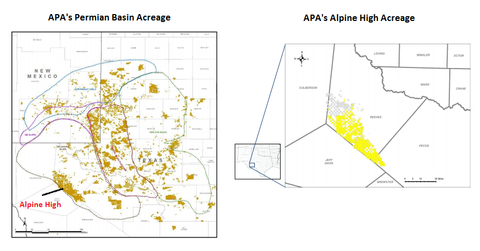

Apache owns 307,000 contiguous net acres in its Alpine High play that have been secured over the past 18 months at an average cost of $1,300 a net acre.

Sept. 12 2016, Updated 8:05 a.m. ET

Alpine High: key highlights

Apache (APA) owns 307,000 contiguous net acres in its Alpine High play that have been secured over the past 18 months at an average cost of $1,300 a net acre. The new Alpine High discovery is further expected to strengthen APA’s Permian position. Other operators in the Permian Basin include Concho Resources (CXO). APA and CXO make up ~3% of the Energy Select Sector SPDR ETF (XLE).

APA’s press release noted that it had 4,000-5,000 feet stacked pay potential in five different formations in the play. These include the Bone Springs, Wolfcamp, Pennsylvanian, Barnett, and Woodford formations.

APA has identified 2,000 to over 3,000 drilling locations in the Woodford and Barnett formations.

The above formations are in the wet gas window, and APA expects to deliver a combination of rich gas and oil from these formations. APA’s press release stated: “Initial estimates for the Woodford and Barnett zones indicate a pretax, net present value (NPV) range of $4 million–$20 million per well, at benchmark oil and natural gas prices of $50 per barrel and $3 per thousand cubic feet (Mcf), respectively.”

Well costs in development

APA also pegged well costs in development mode for a 4,100-foot lateral to be ~$4 million per well in normal-pressured settings and ~$6 million per well in high-pressured settings.

Apache has drilled 19 wells in the Alpine play, of which nine are currently producing “in limited quantities due to infrastructure constraints.” These include six wells in the Woodford formation, one well in the Barnett formation and one in the Wolfcamp and Bone Springs oil formations, each.

APA plans to continue testing the play to ascertain what or how other formations apart from Woodford and Barnett will add to its overall results.