Is Southwest Airlines On Track to Achieve Its Utilization Goals?

In 2015, Southwest Airlines’ prudent approach to capacity growth resulted in the better utilization of its capacity.

Sept. 8 2016, Updated 5:04 p.m. ET

Utilization falls

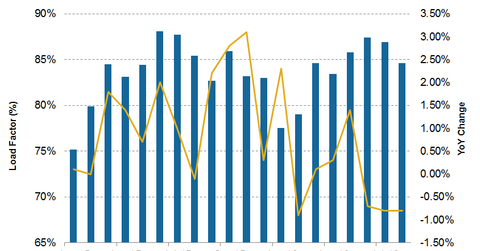

Load factor is the most commonly used measure of an airline’s capacity utilization. It’s calculated by dividing revenue passenger miles (or RPM) by available seat miles (or ASM). A higher load factor indicates better utilization of an aircraft’s capacity.

In 2015, Southwest Airlines’ prudent approach to capacity growth resulted in the better utilization of its capacity. Specifically, the airline’s load factor improved by over 1.1%, from 82.5% in 2014 to 83.6% in 2015. Year-to-date (or YTD) in August 2016, LUV’s load factor also improved by 0.2% to 83.8%.

However, as capacity growth exceeded traffic growth in August, utilization fell by 0.8%. This trend could be detrimental to unit revenue if it continues.

Falling yields

As most airlines continue with their aggressive capacity expansion plans amid falling demand growth, yields have been falling. Most airlines expect this trend to continue in 2016.

LUV witnessed a technology outage on July 20, 2016, due to which it had to cancel about 2,300 flights. This will adversely affect the company’s yields for the quarter.

Outlook

As a result, LUV expects its 3Q16 revenue per available seat mile to fall by 3.5%–4.5% YoY as opposed to its earlier guidance of a 3%–4% fall. The 0.5% increase in the estimate is attributed to the outage.

All other major players—American Airlines Group (AAL), United Continental Holdings (UAL), Alaska Air Group (ALK), JetBlue Airways (JBLU), and Allegiant Travel Company (ALGT)—are expecting falling unit revenues. Spirit Airlines (SAVE) is the only airline expecting its unit revenue to improve.

Southwest Airlines makes up ~0.5% of the total holdings of the iShares Russell Mid-Cap ETF (IWR).