Where Gold Is Likely to Head If the Fed Hikes Rates

The Fed has probably never tightened rates in past cycles with indicators so weak. In fact, at this point in the business cycle, a more normal stance would be to hold steady, looking ahead to a time when it might cut rates. Because of this, we believe any decision to raise rates in 2016 will […]

Sept. 21 2016, Updated 3:05 p.m. ET

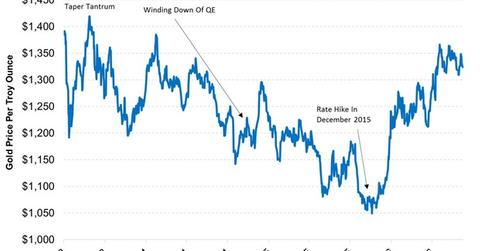

The Fed has probably never tightened rates in past cycles with indicators so weak. In fact, at this point in the business cycle, a more normal stance would be to hold steady, looking ahead to a time when it might cut rates. Because of this, we believe any decision to raise rates in 2016 will ultimately be viewed as a misstep that increases financial and economic risks, and this will be to gold’s benefit. In the meantime, however, the anticipation of a rate increase and any attendant U.S. dollar strength could cause gold to struggle. David Rosenberg of Gluskin Sheff[1. Gluskin Sheff + Associates Inc., a Canadian independent wealth management firm, manages investment portfolios for high net worth investors, including entrepreneurs, professionals, family trusts, private charitable foundations, and estates.] characterizes this anticipated rate increase as the fourth scare of the cycle. The first was the “taper tantrum” in 2013, next came the end of quantitative easing (or QE) in 2014, and then lastly, the actual interest rate increase in December 2015. Each of these episodes lasted no more than a few months with volatility and downward pressure on stocks, bonds, commodities, and emerging markets.

Market Realist – Where gold is likely to head if the Fed hikes rates

The graph above shows how the previous three scares of the cycle, as explained by David Rosenberg, have affected gold (OUNZ)(GLD)(IAU) prices. When the Fed considered winding down its QE (quantitative easing) program back in the summer of 2013, it led to a sell-off in risky assets, including emerging markets (EEM). As that led to a rise in Treasury yields, which are considered a proxy for interest rates, gold prices fell as well. Between August and December 2013, gold prices fell by 15.7%.

The Fed eventually started winding down its QE program in January 2014 and ended it October 2014. Between March and October 2014, gold prices tumbled by 17.2%.

Lastly, the Fed hiked rates for the first time in nine years in December 2015. Gold prices fell by 11.4% in six weeks, which led to the hike.

If the Fed does hike rates in September, gold prices are likely to fall, despite the fact that a rate hike represents a risk to markets. However, as economic indicators could be weak when the Fed hikes rates, the extent of the fall could be limited.