Deutsche Bank Upgrades Goodyear to ‘Buy’

The Goodyear Tire & Rubber Company (GT) has a market cap of $8.2 billion. It rose by 4.8% to close at $31.16 per share on September 6, 2016.

Sept. 7 2016, Published 2:02 p.m. ET

Price movement

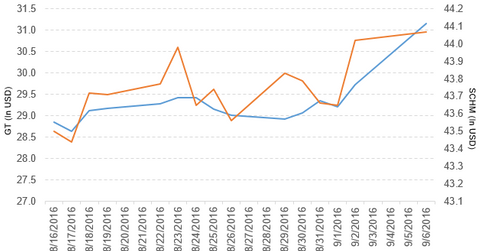

The Goodyear Tire & Rubber Company (GT) has a market cap of $8.2 billion. It rose by 4.8% to close at $31.16 per share on September 6, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 7.7%, 10.4%, and -3.9%, respectively, on the same day. GT is trading 7.3% above its 20-day moving average, 12.6% above its 50-day moving average, and 5.4% above its 200-day moving average.

Related ETFs and peers

The Schwab US Mid-Cap ETF (SCHM) invests 0.27% of its holdings in GT. The ETF tracks a market-cap-weighted index of mid-cap stocks in the Dow Jones US Total Stock Market Index. The YTD price movement of SCHM was 10.8% on September 6.

The SPDR S&P 500 ETF (SPY) invests 0.04% of its holdings in GT. The ETF tracks a market-cap-weighted index of US large and mid-cap stocks selected by the S&P committee. The market caps of GT’s competitors are as follows:

GT’s rating

Deutsche Bank has upgraded Goodyear’s rating to “buy” from “hold” and set the stock price target at $37 per share.

Performance of Goodyear in 2Q16

Goodyear reported 2Q16 net sales of $3.9 billion, a fall of 7.1% from its net sales of $4.2 billion in 2Q15. The company’s cost of goods sold as a percentage of net sales rose by 0.51% between 2Q15 and 2Q16.

Its net income and EPS (earnings per share) rose to $202.0 million and $0.75, respectively, in 2Q16, compared with $192.0 million and $0.70, respectively, in 2Q15. It reported adjusted EPS of $1.16 in 2Q16, a rise of 38.1% over 2Q15.

GT’s cash and cash equivalents fell by 22.9% and its inventories rose by 9.0% between 4Q15 and 2Q16. Its current ratio rose to 1.4x and its debt-to-equity ratio fell to 2.8x in 2Q16, compared with 1.2x and 3.0x, respectively, in 4Q15.

Projections

The company has reaffirmed its projections for 2016:

- core segment operating income growth in the range of 10%–15%, excluding Venezuela

- positive free cash flow from operations

- adjusted debt-to-EBITDAP (earnings before interest, tax, depreciation, amortization, and pension income) multiple in the range of 2.0x–2.1x at the end of the year

In the next part, we’ll discuss Crown Holdings (CCK).