Can the iPhone 7 Drive Sales in China?

According to Strategy Analytics, Apple is now the fifth-largest smartphone player in China.

Sept. 13 2016, Updated 10:04 a.m. ET

Increasing competition for Apple in China

China (FXI) is an extremely important market for Apple. China is also the company’s second biggest market in terms of revenue after the United States. China is the largest market for smartphones in the world, with a number of domestic and foreign players looking to penetrate the market.

According to Strategy Analytics, Apple is now the fifth-largest smartphone player in China. At the end of 2Q16, Huawei was one of the largest players in China. It has an 18% share compared to 16% in 2Q15. Oppo’s share rose from 6.9% in 2Q15 to 14% in 2Q16. Vivo’s share rose from 7.4% to 12% during the same period.

Apple’s market share fell from 9.2% in 2Q15 to 6.7% in 2Q16. According to the Wall Street Journal, one of the major reasons for Apple’s decreasing market share is the delay in technical innovations.

A September 9, 2016, research report by Diario Catolico stated, “Chinese rivals have also been faster to bring some technical innovations to market, introducing the dual-camera system and handsets without headphone jacks months before Apple trumpeted these improvements in the iPhone 7.”

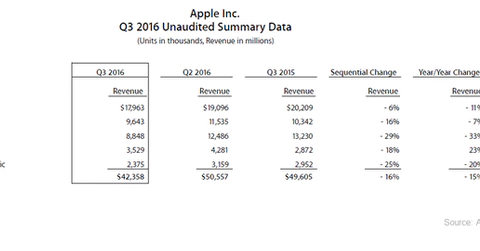

Sales fell 33% in Greater China

Apple’s (AAPL) revenue from Greater China—which includes China, Hong Kong, and Taiwan (EWT)—fell 33% year-over-year from $13.2 billion in fiscal 3Q15 to $8.8 billion in fiscal 3Q16. Sales in fiscal 2Q16 also fell significantly year-over-year in Greater China.

The falling revenue from China (FXI) was driven by the sluggish Chinese economy, as well as the saturation of the smartphone market and a strong US dollar.

Apple generates almost 60% of its revenue from non-US markets. Thus, declining revenues from China and other economies are expected to pose a challenge to the tech giant.