What Are Analysts’ Recommendations for Panera Bread?

Despite the recent fall in Panera’s share prices, analysts are still maintaining their price target of $238.2 for the next year—a return potential of 18.5%.

Sept. 21 2016, Updated 10:04 a.m. ET

Analysts’ recommendations

On September 19, 2016, Panera Bread (PNRA) was trading at $201.1. The share price could have factored in the estimates that we looked at in the previous part of this series.

In this part, we’ll look at analysts’ recommendations and estimated target prices for the stock over the next 12 months.

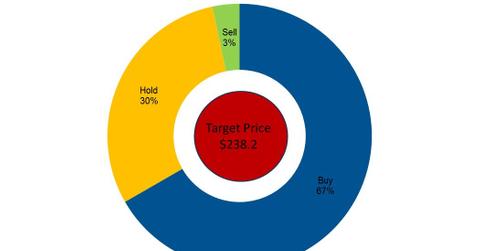

Despite the recent decline in Panera’s share prices, analysts are still maintaining their price target of $238.2 for the next 12 months. It represents a return potential of 18.5%. Nicole Miller Regan of Piper Jaffray, who is more optimistic about the stock, expects Panera’s share price to reach $260—a return potential of 29.3%. On the lower side, Paul L. Westra of Stifel expects Panera’s share price to fall 13% to $175.

The 12-month target prices for Panera Bread’s peers are as follows:

Analysts’ ratings

According to a Bloomberg survey of 30 analysts, 66.7% of analysts gave Panera “buy” recommendations, 30% gave it “hold” recommendations, and 3.3% gave it “sell” recommendations. If analysts raise their target prices on Panera over the next 12 months, the price of the stock could also rise and vice versa.

A share price that’s lower than its target price doesn’t necessarily mean that a stock is an automatic “buy.” Before investing, you should carefully analyze the various metrics that we covered in this series.

Together, Panera and Domino’s Pizza (DPZ) form 0.8% of the holdings of the iShares Core S&P Mid-Cap ETF (IJK).