What Is Analog Devices’ Acquisition Strategy?

Analog Devices (ADI) has been using M&A (mergers and acquisitions) to rapidly expand its technology offerings and boost its revenue.

June 15 2016, Updated 11:05 a.m. ET

ADI’s acquisition strategy

Analog Devices (ADI) has been using M&A (mergers and acquisitions) to rapidly expand its technology offerings and boost its revenue. In the previous part of this series, we saw that a Bloomberg report stated that ADI had offered to acquire its rival Maxim (MXIM), which also had an acquisition offer from Texas Instruments (TXN).

At that time, Maxim had a market value of about $9.2 billion, and it demanded a hefty premium, which was not feasible for ADI and TXN. Hence, both ADI and Texas Instruments backed out. Instead, ADI acquired SNAP Sensor, a supplier of industrial imaging solutions for connected cities and smart building applications.

Now let’s see ADI’s financial position and its capacity to fund future M&As.

Balance sheet

As of April 30, 2016, ADI’s cash reserves stood at $3.8 billion against long-term debt of $1.8 billion. This equates to debt of 1.3 times its EBITDA (earnings before interest, tax, depreciation, and amortization). After repaying the debt, ADI will have net cash of $2 billion to spend on long-term investments such as M&A.

After excluding cash and short-term investments, the company has $830 million in current assets to meet its current liabilities of $685 million. This shows that even after spending net cash of $2 billion, the company has sufficient liquidity to meet its working capital needs.

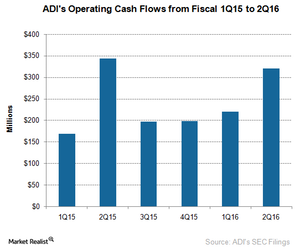

Cash flow

ADI’s operating cash flow has been unstable over the past six quarters, with its lowest cash flow of $197 million reported in fiscal 3Q15. In fiscal 2Q16, the company’s operating cash flow fell by 7% YoY (year-over-year) to $320 million. After excluding capital expenditure, its FCF (free cash flow) stood at $294.7 million.

Over the last year, the company generated FCF of $1 billion and returned the entire amount to shareholders in the form of dividends and share buybacks.

ADI’s ability to fund future acquisitions

The semiconductor consolidation in 2015 created strong competitors for ADI: NXP Semiconductors (NXPI) in the automotive segment and Broadcom (AVGO) in the communications segment. Given ADI’s acquisition strategy, liquidity, and competition scenario, there’s a possibility that it will look for strategic acquisitions.

Next, we’ll look at ADI’s profitability and expenses to understand its operational efficiency. The iShares Russell 1000 ETF (IWB) has holdings in large-capitalization US equities across various sectors including technology. It has 0.05% exposure to MXIM, 0.31% to TXN, and 0.09% to ADI.